Entrepreneur Insight

Contactless Payments: Retail’s New Normal

How the global pandemic gave rise to adoption of touch-free payments and redefined the future of transactions in the post-COVID world.

The COVID-19 pandemic has changed the way people work, buy and pay, while forcing many businesses around the globe to find new ways to operate. The increased health concerns over touching surfaces and handling cash, mixed with social distancing and changing consumer shopping habits, led to a surge in using contactless payments as a way to minimize touchpoints.

While contactless transactions have been widely embraced in other parts of the world for years, the U.S. market has been considerably slow to adopt them. A study released in 2018 suggests that just over 3 percent of cards in use in the U.S. were contactless, compared to around 64 percent in the U.K. and up to 96 percent in South Korea. Fast forward to 2020, and the usage of contactless payments in the U.S. has risen 150 percent since March 2019. Moreover, 87 percent of consumers say they would now prefer to shop in stores with contactless payment options.

Could contactless payments become the new gold standard for retail transactions? And if COVID-19 persists, could it even become mandatory? If so, what do merchants need to do today to appease the changing behavior of consumers and not lag behind? Take a look at what contactless payments entail, the benefits and the considerations of touchless transactions, and how merchants can adapt to a new payment landscape and take part in the future of retail.

The technology behind tap-and-go payments

“Contactless payments, also known as tap-and-go and tap-to-pay, refer to the payment method that is done by tapping a payment card or other device, such as smartphone, fitness tracker, key fob or a smart watch, near a card reader equipped with contactless payment technology, without a need to swipe, enter a personal identification number (PIN) and/or sign for a transaction,” says Dustin Sullivan, vice president and national merchant sales manager at East West Bank.

Contactless payments come in two main forms. First, through payment apps or digital wallets like Apple Pay or Google Pay that securely store credit and debit card information and utilize near-field communication (NFC) technology that allows your device to exchange data with the payment terminal. Secondly, through radio-frequency identification (RFID) technology embedded directly into the debit or credit card. Cards that are enabled for contactless payments have a symbol that resembles a wave, or a sideways Wi-Fi logo, on either the front or back of the card. Both RFID and NFC technologies enable devices and readers to communicate and allow secure, touch-free payment transactions to happen.

Contactless payment works the following way: When a merchant's system prompts a customer to pay, they bring the card or the smart device close to the payment terminal that has a contactless payment symbol. The information is then transmitted electronically from the card’s chip or the smart device to the bank. When the system accepts the tap, the customer is notified with a beep, green light, or a checkmark. Once approval is received, the transaction is complete.

“It is important to note, however, that for contactless payments to happen, the merchant needs to have a payment terminal that has an NFC capability. Otherwise, it won’t work with older card readers,” says Sullivan.

Many merchants also have contactless options available through their apps. “Think how you can now pay for your morning cup of coffee using the Starbucks app, or buy a donut through the Dunkin’ app, not to mention racking up points while doing so,” says Sullivan. “When you order something through an app, you have your credit card information loaded onto it. You don’t have to physically present a card—it would just run it through the system, and then your account would reflect that charge.”

Contactless technology is spreading beyond coffee shops and restaurants to other sectors, like public transit. In 2019, New York Metropolitan Transit Authority (MTA) started rolling out OMNY, a new contactless fare system that allows passengers to simply tap a card to pay for a subway or bus ride. Most recently, Los Angeles Mayor Garcetti announced the new TAP app that enables riders to use their phones to pay for the Metro bus and rail, LA County municipal bus operators and even Metro Bike Share.

A safe, fast and secure way to pay

Contactless transactions can take as little as 10 to 15 seconds, while transactions made with chip-enabled cards can be anywhere between 30 to 45 seconds.

Contactless payments are also more secure because the information submitted through the merchant terminal is encrypted, which makes it difficult for fraudsters to intercept and steal. That’s because in order for contactless to work, a unique one-time token is sent to the payment terminal for each transaction. Since the token doesn’t contain any card information, if the transaction is compromised, that token cannot be used to make another purchase. Digital wallets also have an added security step, which requires customers to verify a transaction with a password, PIN, fingerprint or facial recognition.

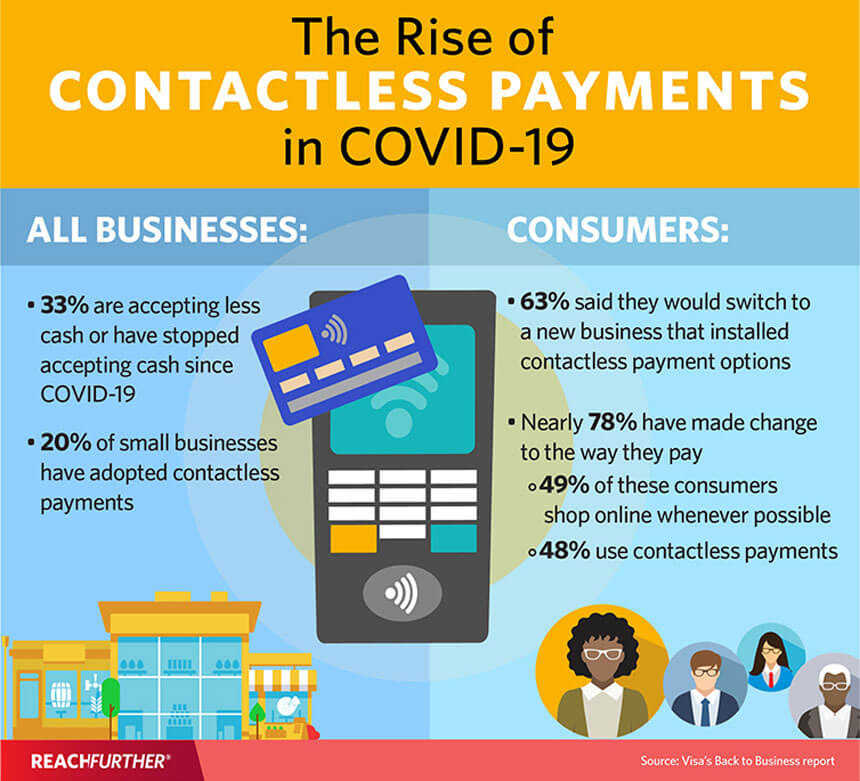

Contactless payments are also more hygienic. According to Visa’s Back to Business study, shoppers are now prioritizing COVID-19 safety measures and will reward businesses that do the same. Nearly 63 percent of consumers said they would switch to a new business that installed contactless payment options, and 48 percent said they would not shop at a store that only offers payment methods that require contact with a cashier or shared machine like a card reader.

Cashing out in the time of COVID

While it’s still not clear whether dollar bills are able to spread the virus or not, what is clear is that the number of cash transactions during the pandemic has gone down. With the global focus on safety and hygiene, a third of small businesses report that they have accepted less or stopped accepting cash since COVID-19, and another 20 percent have adopted contactless payments.

In particular, the younger generation of business owners has been quicker to adopt contactless payments. Forty-one percent of millennial small business owners reported that, since the beginning of the pandemic, they started accepting less cash or stopped accepting cash payments altogether, compared to 31 percent of Gen X and 21 percent of Boomers.

On the consumer side, the Visa report reveals that nearly four in five consumers have changed their shopping practices due to the pandemic. Forty-nine percent of consumers started shopping online as much as possible, 46 percent started using less cash and 48 percent started using contactless payments. Furthermore, nearly 50 percent of consumers around the world plan to use less cash even after the pandemic is over, and almost 70 percent believe that the transition to cashless payments will be long-lasting.

Contactless payment options for merchants

When it comes to choosing a point-of-sale (POS) terminal that’s enabled for contactless payments, there are myriad options available on the market. They include Elavon’s Poynt, Ingenico, Verifone, Square and other products, and each has its own unique features.

“Merchants who don’t have terminals enabled for contactless payments and who want to upgrade should contact a company like East West Bank, that has an expertise in contactless payments,” says Sullivan. “Our team can recommend to merchants the right terminal and also ensure that they have the right setup, as well.”

In certain cases, cardholders who use debit cards to pay for contactless transactions may be asked to enter a PIN, requiring them to touch a keypad or device screen. Depending on the terminal, merchants can bypass the PIN entry on debit card payments. If merchants use the Poynt, Ingenico or Verifone terminals, instructions on how to do it can be found here. In some cases, merchants need to use the most up-to-date software version on their existing payment device to enable their card readers to accept contactless cards and digital wallets.

“Another way merchants can accept contactless payments is through QR codes, which can be used in a non-digital format, such as flyers, paper invoices and even on newsletters,” says Sullivan. “They hold a large amount of information, can be read with any smartphone, and can quickly connect to any digital platform and/or website.”

"Another way merchants can accept contactless payments is through QR codes, which can be used in a non-digital format, such as flyers, paper invoices and even on newsletters. "

Having this technology in place is certainly a good foundation. However, merchants need to connect with their customers to make sure they are fully capable of contactless payments, and then encourage contactless payments at the time of transaction.

Transaction size limitations

“Since contactless payments do not require a signature or a PIN, the transaction sizes on the cards are limited,” says Sullivan. The exact amount that cardholders can spend varies by the country, the bank, the card issuer and sometimes even the merchants themselves. If merchants want to limit or prevent fraudulent transactions, they may deliberately set a low limit for their contactless payment transactions.

However, in an effort to prevent the spread of COVID-19, Mastercard and Visa, as well as many countries around the world, started to increase spending limits to allow larger transaction sizes. The limit increase ranges anywhere from 25 to 400 percent, with an average contactless limit increase of 130 percent.

Future outlook

While touch-free payments were already becoming more widely adopted well before the current health crisis, it’s quite certain that contactless payments will have a big impact on the future of retail.

While cash is not going anywhere for now, transactions that require no physical contact have proven to be a convenient, if not preferred, way for customers and retailers to conduct seamless, fast, secure and socially distant transactions during the pandemic. Consumers who are trying contactless payments for the first time will likely continue to appreciate the ease and speed of it long after the pandemic is over. Merchants who want to keep up with digital acceleration trends, keep their business afloat, and not just survive these difficult times but succeed beyond it, need to get on board with contactless payments.

Contact East West Bank Merchant Services Team

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.