CDs

Power Your Savings With CDs

Certificates of Deposit (CDs) are an effective, low-risk form of investment.

Open a CD today to lock in a great rate and earn steady returns.1

Fixed interest rates, compounded daily

No opening or maintenance fees

$1,000 minimum balance

Flexible terms from 32 days to 5 years

FDIC insured up to $250K per depositor, per insured bank, for each account ownership category

A CD is an interest-bearing account, where funds must remain in the account for an agreed upon period of time, or “term.” You choose the investment term that works best for you—our CD terms range from 32 days to 5 years. Early withdrawal penalties will apply if funds are withdrawn before term maturity.

Generally, CD accounts let you earn a higher rate of return on money you know you won't need for a while. The fixed interest rate is guaranteed for the term of the CD if funds remain in the account until term maturity, making CDs a great low-risk investment option.

Want to learn more?

To be eligible to open a CD from our

Mobile App or Online Banking Service,

you must first have a qualifying

checking or savings account.2,3

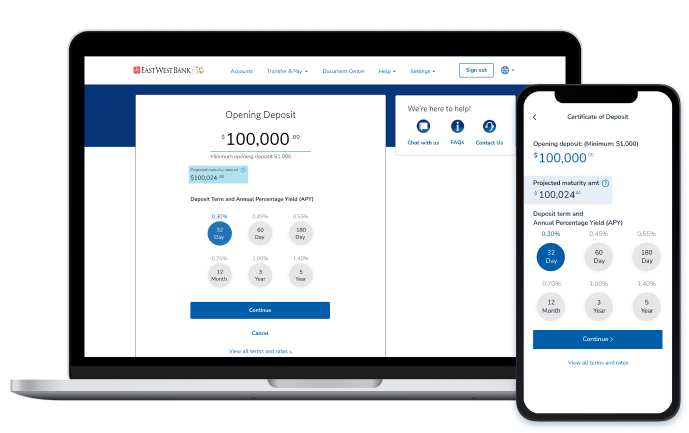

Log in to our Mobile App or Online Banking Service and select “Savings”, then “CD” from “Explore Products” on the Dashboard.

Select the CD opening deposit amount and term that best suit your needs.

Confirm your contact information, submit your application, and fund your CD from your qualifying checking or savings account—all within minutes.

Check your email for your new CD confirmation, and you’re all set.

1 CD Annual Percentage Yields (APY) may vary based on term and opening balance. Early withdrawal penalties may apply. Fees may reduce your earnings. Please refer to the additional disclosures received at account opening for complete terms, fees and conditions.

2 Use of East West Bank’s mobile banking application requires a data connection. Wireless carrier charges may apply.

3 To open and fund a CD in our Mobile App or Online Banking Service, you must have a qualifying East West Bank checking or savings account held individually or jointly in your name. See Product Terms and Conditions for additional requirements.

East West Bank’s privacy and security policies do not apply to the website or app you’re about to visit, and we are not responsible for the products, services or content found there. Please review its terms of use, privacy and security policies to see how they apply to you.