U.S.-Asia Business

Self-Driving Cars: Putting the “Auto” in Automobile

By

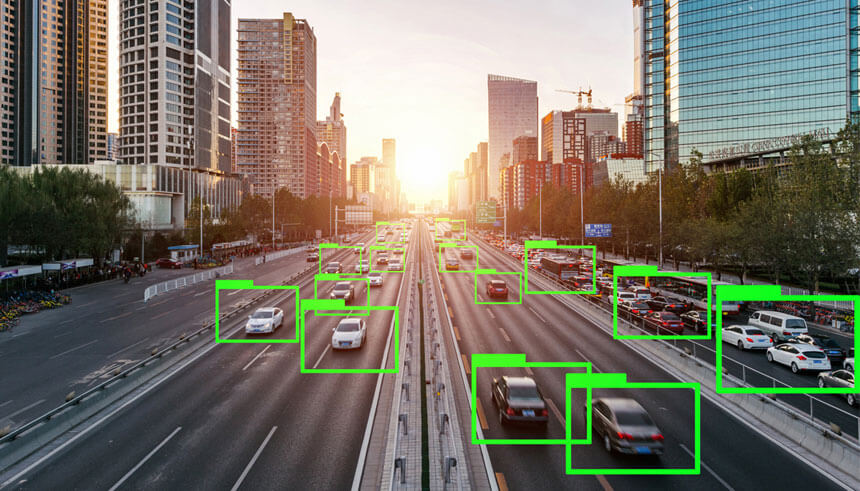

Opportunities and realities in the autonomous vehicle industry in the US and China.

From veteran carmakers like Ford, to tech behemoths like Google, it seems like everyone is investing in the autonomous vehicle space. According to Statista, by 2025 the global autonomous vehicle market is projected to reach $36 billion for partially autonomous vehicles and $6 billion for fully autonomous vehicles. Proponents of self-driving cars tout the increased safety, accessibility, efficiency, eco-friendliness (if coupled with clean energy sources), and generally higher quality of life as among the main benefits to society. However, on the heels of several highly publicized and fatal accidents involving self-driving cars, consumers have become less sure of such a concept. Nevertheless, advocates firmly believe that AV is the future and that the industry is rife with business opportunities.

The feasibility of an autonomous society

The adoption of autonomous vehicles isn’t going to happen in one fell swoop, but rather in waves—starting with business-to-business use.

John Adams, a managing director at design firm Gensler, believes that adoption of autonomous trucks for commercial purposes will happen in the next 3-5 years. “What we’re hearing is that things like transit of goods from one coast to the other—that’ll be the first thing to really, at scale, be automated,” Adams shares.

Already, companies have launched autonomous trucks on the roads. Embark, a self-driving semi-truck startup, has successfully delivered refrigerators in the state of California using their trucks (albeit with a human driver riding in the cab). Tesla has also been testing all-electric automated semi-trucks, which are set to go into production in 2019, and Uber has also used its self-driving trucks to haul cases of Budweiser beer across Colorado.

"We as human beings need to be comfortable in these cars…I think it’s going to take a generation before we massively adopt that."

Part of the reason widespread commercial adoption will likely come first is because of federal support. Rudy Salo, a partner at law firm Nixon Peabody who specializes in transportation finance, mentions that the U.S. Department of Transportation recently released a report on the future of automated vehicles. Salo points out that the federal government governs regulation of commercial vehicles.

“They can invoke their supremacy clause if there are any state regulations out there that are trying to regulate changes to commercial activity,” says Salo. “They also pointed out the dearth of commercial drivers—it makes sense that those would fill the gap there.”

Challenges to mass consumer adoption

Consumer adoption is another story. After a few high-profile accidents involving autonomous vehicles, consumer sentiment has been down. According to Fox Business, 49 percent of survey respondents said they would never own a fully autonomous car, up from 30 percent who said so in 2016. In that same survey, 45 percent of people said they believed roads would be safer if all vehicles were fully autonomous, down from 63 percent in 2016. However, among millennials, 61 percent said they wouldn’t rule out purchasing a fully autonomous vehicle.

Salo says it’s going to take a complete overhaul to change perceptions of autonomous vehicles. “We as human beings need to be comfortable in these cars,” he explains. “Meaning that, we’re allowing these cars to drive us without letting us take control—so that’s a mindset shift. I think it’s going to take a generation before we massively adopt that.”

What could increase the safety and reliability of autonomous vehicles—and therefore raise public perception—is the integration of autonomous vehicles into smart infrastructure, which those in the industry refer to as vehicle-to-infrastructure (V2I). However, developing V2I infrastructure poses its own challenges, and Genevieve Giuliano, Ferraro chair at the University of Southern California’s Sol Price School of Public Policy, believes it’s going to be “decades” before that happens on a wide scale.

“We need the infrastructure to be talking to the vehicles,” says Giuliano. "If they’re talking to each other—that’s fine. But what’s more important is for the rest of the system knowing where [they] are, whether they’re approaching, how they get the other vehicles out of the way, etc. We need physical infrastructure talking to the vehicles.”

Who will pay?

All that physical infrastructure doesn’t come cheap—someone will have to cover the costs, and the answer to “who” remains unclear. Giuliano believes that the people reaping the most benefits from autonomous vehicles should be the ones to shoulder the burden.

“We have enough technology to be able to price where you bill—on a mileage basis, however you want it,” she explains. “We can vary the price by when you’re in downtown Los Angeles causing all kinds of congestion, or when you’re somewhere else where you’re not.” However, Giuliano admits that convincing a government or regulators to enact such a thing would be incredibly difficult.

Another solution would be to get big business such as oil companies to invest in infrastructure or autonomous and connected solutions. In fact, Sven Hackmann, executive vice president at transit startup NEXT, says that his company has already been approached by oil companies. “We’ve been in discussions with many of the big oil venture funds, and they are looking to diversify,” he says. However, he says that there is disconnect with the “petroleum contract,” where people are still accustomed to an old but working system.

“Show them the will of the community and the integrated plan that will deploy your vehicles, and then they will go to equity invest in your company,” advises Hackmann. “If you have that, the infrastructure will be so much more likely to get behind that.”

Areas of opportunity in the autonomous vehicle market

To produce a fully autonomous vehicle, it needs to be connected to other vehicles, the physical infrastructure, traffic signals—everything. In order to successfully do that, it will require high-speed, high-capacity telecommunications and tech companies that are skilled at building advanced operating systems. For instance, China’s Baidu, the country’s largest search engine, is building an open-source platform called Apollo through which its partners can develop their own operating systems, and has even partnered with U.S. automaker Ford to test autonomous vehicles in China.

“Everything needs to be connected, but how are you going to do that?” posits Salo. “You need 5G internet, or whatever higher broadband internet, laid out everywhere. That is very, very expensive, and that will take some power.” Salo mentions that one of the major problems in the U.S. is the fact that over 23 million Americans in rural communities don’t have broadband internet. “People are still trying to figure out how to get everyone online onto lower speeds,” he says. “If you really want to have a connected society, you got to make sure that the rural communities are connected—you can’t just focus on the urban communities.”

With the increased interconnectivity comes the need for better cybersecurity. “All of these computer-fed vehicles that have families relying on the accuracy of the GPS down to a couple of inches—what happens if someone gets in and monkeys around with that?” asks Adams.

Of course, tech companies aren’t the only ones that can get a slice of the autonomous market. In 2016, Reebok already designed a workout that could be completed in the front seat of a self-driving car. The company also teamed up with Gensler to reimagine and repurpose gas stations as fitness centers, once vehicles have become fully autonomous, connected and electrified.

"We need the infrastructure to be talking to the vehicles. If they’re talking to each other—that’s fine. But what’s more important is for the rest of the system knowing where they are, whether they’re approaching, how they get the other vehicles out of the way."

China’s autonomous vehicle industry

Although Salo believes that the United States currently has the technological advantage over China in terms of autonomous vehicles, he thinks that gap is closing fast. China has made no secret of its desire to become a global tech leader, and the government has supported autonomous vehicle initiatives as part of its plan. China hopes to have 30 million autonomous cars on the road by the end of the next decade, and its autonomous vehicle industry could be worth $500 billion by 2030. Baidu has also set its sights on taking its artificial intelligence and autonomous vehicles outside of China and to foreign markets.

China has one of the world’s largest electric vehicle markets and has 500 smart city projects—the highest number in the world. Chinese consumers also lack the legacy of personal vehicles that American users have. Those things combined suggest that China could become one of the largest self-driving automobile markets, believes Salo.

“They really are starting to build out connected cities, and they’re laying out the infrastructure so that an autonomous connected vehicle future makes a lot of sense there,” he explains.

Nevertheless, there are opportunities for U.S. companies to work together with Chinese ones, just like with Baidu and Ford.

“I do think there are other ways for China and the United States to work together, and I see that happening,” shares Salo. “American startups maybe want to take advantage of manufacturing in China, and I’m sure there will be a lot of Chinese companies that will invest in American startups.”