U.S.-Asia Business

Now What? Strategies for Navigating US-China Tariffs for Businesses

By Daisy Lin

Specific steps companies can take to minimize the impact from the US-China tariffs.

The e-commerce handbag brand Scarleton is one of the many businesses in the U.S. feeling the impact of the U.S.-China tariffs. An overseas container filled with Christmas merchandise from China was arriving at the port in Los Angeles, and CEO Emily Wang was worried about how much more she would have to pay in duties for the shipment. She called her broker and got the disturbing news—it was going to be a lot more.

“I did not expect that this will happen,” Wang says. She would have tried to stock up on inventory ahead of time like some companies, she says, but that was risky too from a business standpoint. “By the time it happened, it was too late.”

“About a year and a half ago, when the administration took over and started talking about tariffs, there were a lot of people who thought this is really just talk. It’s never going to happen,” says Donald C. Hok, senior manager, Washington national tax, trade and custom at KPMG. “Fast forward to today: there’s a lot of confusion, a lot of anxiety from companies.”

Caught in the middle are small and mid-sized businesses, which are less able to absorb a price increase than big retailers. Wang’s customs broker told her that a 25 percent duty would be charged on top of the 16 percent she already paid in taxes and fees. That means, if she imported a $10 bag, she would have to pay $4.10 in duties on that bag. In that case, Wang says, the prices may eventually have to be passed on to the consumers, otherwise she will lose money.

“I did not expect that this will happen.”

The Federal Reserve’s recently released Beige Book, which reports on economic activity in its 12 U.S. districts, says that, nationwide, manufacturers reported that they had to raise prices out of necessity because the costs of raw materials rose as a result of the U.S.-China tariffs. Retailers were also worried about cost increases.

What to do, then, in the face of the escalating geopolitical maneuvering? Hok says there are strategies that companies can take now to mitigate the current and future effects.

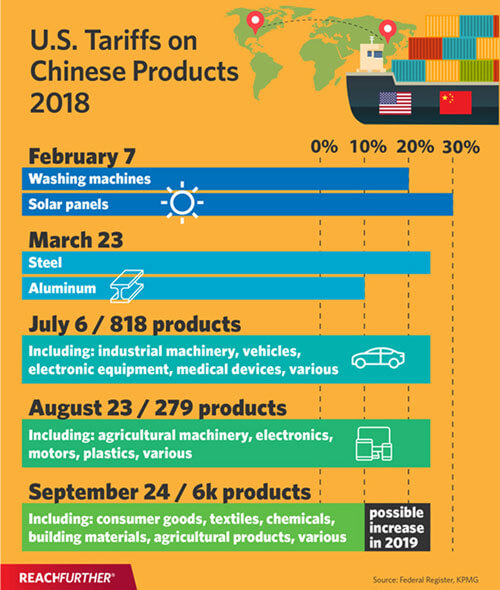

Year of the tariffs

In February, the U.S. imposed tariffs on washing machines and solar panels. In March, tariffs on steel and aluminum went into effect. Then the Trump administration invoked Section 301 of the Trade Act of 1974, and another two rounds of tariffs were implemented in the summer upon a much wider range of products, with a 25 percent tariff on electronic equipment, vehicles, industrial machinery, motors, plastics, and other items worth $50 billion. In September, a massive third round went into effect, with a 10 percent tariff on another $200 billion worth on more than 6,000 products across many industries, including consumer goods, textiles, agricultural products, and more. That third round tariff rate is expected to rise to 25 percent in January 2019. Roughly half of all products Americans buy from China are being affected, and the Trump administration has threatened to extend the tariffs to all Chinese products across the board. So far, China has responded with its own retaliatory tariffs on a total of $113 billion worth of U.S. imports.

“About a year and a half ago, when the administration took over and started talking about tariffs, there were a lot of people who thought this is really just talk. It’s never going to happen. Fast forward to today: there’s a lot of confusion, a lot of anxiety from companies.”

So how can businesses respond to the U.S.-China tariffs and the uncertain future if the situation continues to escalate? Hok says it’s not a matter of doing one single thing. “It’s going to require a nimble approach that is surgical in application,” he says.

First, measure impact

Hok recommends businesses first understand the big picture and determine how much they actually import. This information can be pulled from the government for free through the Automated Commercial Environment system (ACE), through which the trade community reports imports and exports. Once you have the import data for your business, you are better able to assess the magnitude of tariff impact.

Then, to calculate your dues, the next step is to research how your product is classified through the harmonized tariff schedule (HTS), which categorizes all merchandise imported into the United States. Every product has a code, which can be used to check whether the product is on the tariff list.

Once you have the code, then you need to determine the country of origin of your product. These two factors combined will determine the rate of duty. “Make sure it’s actually Chinese in origin,” Hok says. Sometimes products are shipped from China, but the products are not originally from there.

Hok cites the example of a construction crane importer, who was preparing to re-route production out of China, which would have cost millions and taken years to complete. During the review of the products’ classification, he found out that the company had been given the wrong classification by its broker, and that their products were actually not subject to the U.S.-China tariffs.

Another example Hok cites is that of importers of drills from China. The origin review found that, although the assembly of the product was performed in China, the motor, which made up the essential character of the drill, was actually produced in Denmark. Therefore, the drills were not subject to the tariff.

If the country of origin of your product is China-based, some companies may be able to strategically shift a fraction of their manufacturing process to another country, so that the products would no longer be considered of Chinese origin, Hok says. There may not be a need to shift the entire process, only a smaller part of it, in order to change the classification.

There is also the possibility of redesigning products to get more favorable tariff classifications. This would require careful documentation and planning, and consultations with brokers or experts beforehand.

Core trade strategies

In addition, a number of trade-planning tools are available for small to mid-sized businesses to cut down on costs, Hok says.

- Creative restructuring— As part of a customs rule that went into effect in 2016, retailers and e-commerce companies can import products up to $800 in value, to one customer per day, without paying any duties or filing a formal entry. This may be particularly useful for some e-commerce companies to have suppliers fulfill some orders directly to U.S. clients.

- Duty drawback— If you import goods into the U.S. and pay a duty, then subsequently export that same product or similar product, you can get a refund of 99 percent of the duties you paid. The law recently changed to allow even greater ability to match imports to exports in both manufacturing or distribution settings, and this can lead to a significant savings, Hok says.

- Foreign-trade zones—If you are importing goods and move them into an FTZ, which are areas in the U.S. considered outside the customs territory, then those products are not subject to duties until the products leave the FTZ for the U.S. market. This can lower brokerage costs, and help with better cash flow. Although this method has limited applications, it can be useful in the long run, according to Hok.

- Cost unbundling—Businesses can split out certain add-on costs from the value of the imported product, such as some transportation costs, security, handling charges and marketing fees, so that you’re paying duty on only the product itself.

- First sale for export—This allows an importer to cut out the middleman costs from the dutiable value, and be taxed just on the original price of the product, which can significantly reduce the annual duty.

“It’s going to require a nimble approach, that is surgical in application.”

Long-term solutions

Oak Valley Hardwoods CEO Jimmy Lee, an East West Bank client, saw the trade war coming from way off. “We predicted this would happen a couple of years ago,” he says. Lee owns 10 lumber mills in North Carolina, Virginia and Tennessee and employs more than 250 local workers.

Eight years ago, 100 percent of his lumber was sold and shipped to China, fueled by the demand for fine wood furniture and flooring. Even though business was robust, he still decided to diversify his customer base, hire new salespeople, and focus on domestic sales and other markets. Today, only 20 percent of his wood goes to China. Fifty percent stays in the U.S., and 20 percent goes to Vietnam. And now because of the U.S.-China tariffs, he has fewer competitors.

“No problem is too big to be solved,” Lee says, adding a lumber industry pun: “You have to see the forest for the trees.”

“No problem is too big to be solved… you have to see the forest for the trees.”

Not everyone has the foresight that Lee had, but many are looking at long-term solutions, since it is uncertain how long the U.S.-China tariffs will be in place. Hok says it’s time to look at your manufacturing and supply chain, and evaluate whether or not your sourcing has to be changed. It’s also a good time to revisit terms of your contracts.

In some cases, it may make sense to switch. Fuling Global Inc., which manufactures drinking straws in Pennsylvania for major fast food chains like Subway and Burger King, imports plastic from China. With the U.S.-China tariffs raising costs, they had to quickly find a new source for raw materials. They found a new supplier in Taiwan, and were able to facilitate the deal with letters of credit from East West Bank to ensure a smooth transition.

However, moving operations wholesale takes a major commitment of time and money, and it may not have to come to that for some businesses.

“We have some clients—they manufacture a very complicated product, and it could have 100 steps to it. If you move steps one to 30 to Vietnam and the rest of it stays in China…you could still take it out of country of origin China,” Hok says. “Businesses have to pay attention to what opportunities are available. Because there’s no fixed timeline for the tariffs, you don’t want to commit too much of your resource into any one bucket—because this could all go away in a year.”