U.S.-Asia Business

Long March of the Machines

By Daniel Allen

The challenges and opportunities of China's robotics revolution.

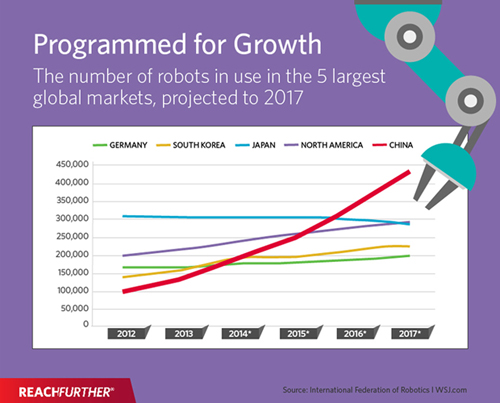

China is currently experiencing an unrivaled surge towards automation, as it buys and builds robots faster than any other nation. According to the Frankfurt-based International Federation of Robotics (IFR), China installed 87,000 new industrial robots in 2016, with about a third produced by Chinese manufacturers. This figure is expected to continue growing annually by up to 20 percent between 2018 and 2020.

With China eager to catch up with Japan, South Korea and other leading high-tech manufacturing nations, increasing automation underpins the Chinese government's drive to develop cutting-edge factories. The Chinese electronics and automotive sectors are currently the main buyers of robots.

Aiming to transition the Chinese economy up the value chain, Beijing has set a target of 150 robots per 10,000 workers by 2020 (it currently stands at around 50 per 10,000, compared to over 300 in Germany and around 175 in the United States). Heeding the call, Guangdong Province, China's top manufacturing hub, is currently investing $150 billion into industrial robots and new automation centers, with other provinces following suit.

The Chinese government also wants domestic robot makers to account for half of all robot sales in China by 2020. Such manufacturers can expect preferential treatment, including subsidies, low interest loans, tax waivers and rent-free land.

"The key drivers of China's robotics revolution are rising Chinese labor costs, a shortage of skilled workers and an aging population," says Catherine Simon, CEO of French robotics consulting firm Innorobo. "This, coupled with the burning desire to make ‘Made in China’ a high-tech brand."

Georg Stieler, Shanghai-based managing director of German technology consulting firm STM and a Chinese automation industry expert, says Beijing knows that it cannot miss out on the next industrial revolution. "This explains the vast sums currently being invested in automation," he says.

Narrowing the gap

On the back of strong government support, the Chinese robotics market is undoubtedly booming. Yet as with many other economic developments in China, rapid growth is accompanied by some volatility. In the past, other industries, such as construction, agricultural machinery and machine tools, have boasted similar growth rates for several years, only to fall back.

"We are seeing some signs of overheating," says STM's Stieler. "I wouldn't be surprised to see some kind of normalization in 2018."

But there are key differences between the Chinese robotics industry and other conventional machine sectors. With China already home to the world's largest industrial robot base, the amount of robotics-related data being generated is an important advantage when it comes to the next challenge—making robots smarter. China's new cybersecurity law restricts cloud-based services to local partners, which means all such data needs to be processed inside the country.

"Data-driven services will enable Chinese companies to develop innovative, value-added robotics capabilities across the board," says Stieler. "Combined with the rise of artifical intelligence and deep learning, we are going to see increasingly sophisticated Chinese robots, diversifying applications and falling prices leading to sustained demand. People should expect surprises."

“We are going to see increasingly sophisticated Chinese robots, diversifying applications and falling prices leading to sustained demand. People should expect surprises.”

Despite a lack of indigenous know-how, Jeff Burnstein, president of the Michigan-based Association for Advancing Automation, agrees that China has the potential to become one of the global lead markets for robotics.

"We already are seeing Chinese companies, like Shanghai-headquartered Siasun, developing robots capable of competing globally with products made anywhere in the world," he says. "This trend will accelerate as China continues to execute its Made in China 2025 plan."

Leveraging demand

Every big Western robot manufacturer is now ramping up production capacity to meet Chinese demand. These include companies like Rethink Robotics and iRobot in the U.S., and ABB, Siemens, Fanuc and Yaskawa from Europe and Japan. Component suppliers are also working hard to expand their presence in China. German robot maker Kuka, which was bought by Chinese appliance manufacturer Midea last year, has already stated its desire to become top robot supplier in China.

Large Western robotics multinationals go where demand is strongest within the Chinese market. With many Chinese robotics manufacturers still playing technological catch-up, they can currently pick the lowest hanging fruit on a massive scale.

"When it comes to opportunities for Western robotics companies, China's electronics and automotive sectors are currently the most fertile," says the Association for Advancing Automation's Burnstein. "But other industries, such as warehousing, logistics and food, will start to offer increasing opportunities going forwards."

Robotics applications in China are already heavily diversified, with many boasting characteristics unique to the Chinese market.

"China has a huge 3C (computer, communications and consumer electronics) manufacturing industry where many applications are unprecedented," says James Li, head of ABB Robotics in China. "Another Chinese industry which is also very different from the rest of the world is logistics, with hugely demanding robotics requirements in terms of capacity and efficiency."

Western robotics multinationals may be making hay while they still can, but opportunities for companies at the smaller, less established end of the scale are more difficult to identify and exploit.

"Smaller Western companies involved in robotics need to understand where to go and with whom to partner," says Innorobo's Simon. "Their first entry into the Chinese market must be a good one. It really pays to engage knowledgeable consultants."

China is in the process of constructing a whole slew of industrial parks focusing on robotics, with the largest, a $302 million complex owned by Siasun, opening in the northeastern city of Shenyang last October. Siasun's new park is intended to serve as an "ecological platform" integrating industry, finance, education and innovation.

With so much money being invested and so many parks opening, it's not easy for Western robotics SMEs and start-ups to decide on a China strategy.

"Some innovative SMEs are waiting for fear of having their development plans too disrupted by the size and the pace of the Chinese market," says Simon.

Future focus

Competition is already high within the Chinese robotics sector, with diminishing margins for standard applications. Those firms looking to tap highly profitable new revenue streams will need to develop innovative applications and come up with purposeful concepts that take into consideration the possibilities of cloud-based robotics, increased flexibility, and easier operability through deep learning and a wider use of simulation.

"Such adaptation to a continually evolving marketplace is not restricted to China," says STM's Stieler. "But China-based robotics firms must also take into account the specifics of the local market, such as operating under the new cybersecurity law."

Over the short to mid-term, the most lucrative Chinese robotics market segment for Western companies will continue to be industrial robotics and factory automation, in terms of both complete solutions and components. Hundreds of Chinese robot manufacturers have aggressively rushed into the multi-axis robotics market, yet it will still take them some years to develop their own advanced control and algorithm technology.

Yet it would be foolish to underestimate the ability of China's robot makers to catch up with their Western competitors.

"The foreign-domestic dynamic will continue to rebalance in China's favor," says Innorobo's Simon. "For this reason, it is important for Western firms to look for active cooperations in new areas of robotics. These include sectors such as B2B, logistics, surveillance and security, agriculture and healthcare."