Insights

Yes or No: Getting Clear Answers from Potential Investors

By Melody Yuan

How entrepreneurs can get investors to financially commit to their business ventures.

Soliciting for money is often described as being “awkward,” “arduous,” and even gut-wrenchingly “painful,” by entrepreneurs looking for investors. The elevator pitch is everything, but after you’ve presented your idea, service or product, the suspense builds as you wait for an answer from investors. When the commitment doesn’t come through, it’s easy to get discouraged or think that soliciting for money is a waste of time.

“Nothing really prepared me for this,” says Gideon Welles, president and founder of Black Dragon Movie Corp. “None of us on the team had any formal training, and all we could do was prepare to the best of our knowledge by reading about how to fundraise.”

Tracy Lawrence, founder and CEO of the venture-backed food service company Chewse, agrees with the sentiment of general unpreparedness for fundraising. “Really, two-thirds of my job is around fundraising, which no one ever tells you about when you’re thinking about building your own startup,” she says. Despite the lack of experience, her company managed to raise $7.3 million in 2017, totaling $15 million since its inception, with prominent investors backing Chewse.

“I had the gumption to start Chewse when I was 20 and enter a fundraising world that wasn’t exactly friendly to women,” says Lawrence. “But I was fueled by the core story: If I want it badly enough, I can succeed no matter what.”

Attracting the right investors

In a recent panel hosted by CAUSE, Lawrence spoke of her experience in raising venture capital money as a female CEO and entrepreneur.

“I’ve been told that I’m not confident when I pitch, and it’s taken a long time to rewrite that narrative,” shares Lawrence. As if it was a self-fulfilling prophecy, the more Lawrence was told about her non-aggressive investor approach, the more she felt unsuited for her role as an entrepreneur. “The language stuck with me and caused me to doubt myself and stumble during my investor pitches,” she says. Lawrence recalls one particular instance where an investor she admired rejected her company. “The day he was supposed to come on-site to meet with us, he gave me a phone call. He had already called many of our clients, who gave glowing reviews about our business. And I remember him distinctly following that up by saying, ‘Unfortunately, we don’t have the conviction to move forward. We don’t believe you’re out for blood.’ I think I hung up the phone and cried for a day. I eventually came out of that experience with the realization that going out for blood was never my style.”

Despite that financial setback and perpetual feedback indicating that she wasn’t ruthless enough to make it in the business world, Lawrence defined her own values and used that to attract the right types of investors.

“We were never a team driven by blood—we’re driven by a devotion to growth and our mission of bringing communities together over food,” says Lawrence. “It makes us incredibly goal-driven and execution-focused. It’s thoughtful and calculated, but no less aggressive.”

Part of what helps her move the conversation forward with potential investors is putting emphasis on actionable items.

- After pitching to investors, immediately ask them for a follow up meeting. Have a solid time frame and guideline in which the investor can assess and answer your pitch. The faster you can move this process along, the more commitment you’ll receive.

- Because your business is probably not the only business your investor is considering, be sure to consistently stay on their radar. Whether that’s a thank you e-mail or a follow-up e-mail emphasizing something new in your product or service that they should check out, be sure to remain active in your communication.

- Create excitement and build momentum. Have third-party endorsers who can contact your investor from other touchpoints. This also helps signal a sense of urgency to support your product or service.

- Remember to build a relationship with your investor. Rather than asking for money over and over again, change the angle and see if you can meet up in person for coffee to receive feedback on your pitch.

Find a way to help your investor and follow up by inserting your product or service into improving their situation.

For Welles, his team’s initial production budget came from two private investors who they pitched separately. “One investor was from Taiwan and the other was from the U.S.,” says Welles. “It goes without saying that professional decorum is of the utmost importance. Assume that people are only going to give you one phone call or one meeting.” Knowing this, it was imperative for the team to have everything ready: from having the numbers supporting their production vision, to anticipating the questions that would be asked, as well as having questions to ask the investors. Welles was able to secure funding through high levels of preparation.

Venture capital funding

Since investors are essentially buying private equity stakes in startups and enterprises with potential, business owners must give a compelling reason for investors to believe in their business vision. Venture capital (VC) funding has recently grown, with U.S. startups collecting more than $67 billion in VC funding and setting a new record in 2017. Of this $67 billion, however, female-led startups and companies received only 2 percent of the funding. This shows a large financial discrepancy in the types of businesses venture capitalists support. Despite the single-digit numbers, Lawrence was able to successfully secure VC funds for her company, once she changed her pitching strategy.

“You have to sell them your vision, and that’s not easy,” continues Lawrence. “And you have to sound confident while doing so.” Thanks to the feedback she received from mentors and investors, Lawrence was able to redefine the type of company she wanted to create and foster. She started to pitch her company brand differently to target a different kind of investor. “Today, we’re proud of the fact that Chewse is a love company, and that’s the type of culture we value at my startup,” she says. “Anyone who’s interested in investing with us knows this about our business model first and foremost.”

Currently managing office meals for more than 700,000 employees up and down the West Coast, Chewse is a modern-day startup success story, having received funding from notable investors like Chris Sacca and the co-founder of Seamless, Andy Applebaum. “We’ve raised about $15 million altogether,” says Lawrence. “Over the course of a year in San Francisco, we’ve managed to triple our sales and raise our margins by 50 percent.”

The initial impressions that venture capitalists receive come from the business founders, and the decision of whether or not to invest can take place in a matter of minutes. Since so few startups actually succeed, investors need to be on board with your business idea and growth strategies early on. They also need to be convinced that the marketplace is ready for the particular idea or product that’s going to launch. The follow-up should also be swift, preferably within the week, and persistent with a call-to-action in order to strike while the iron is hot. Don’t be discouraged if investors don’t respond immediately; try different communication channels to make sure they are fully aware of your efforts to reach out, and create a sense of urgency with a message that includes them as a centrifugal force for the success of your business.

Crowdfunding campaigns

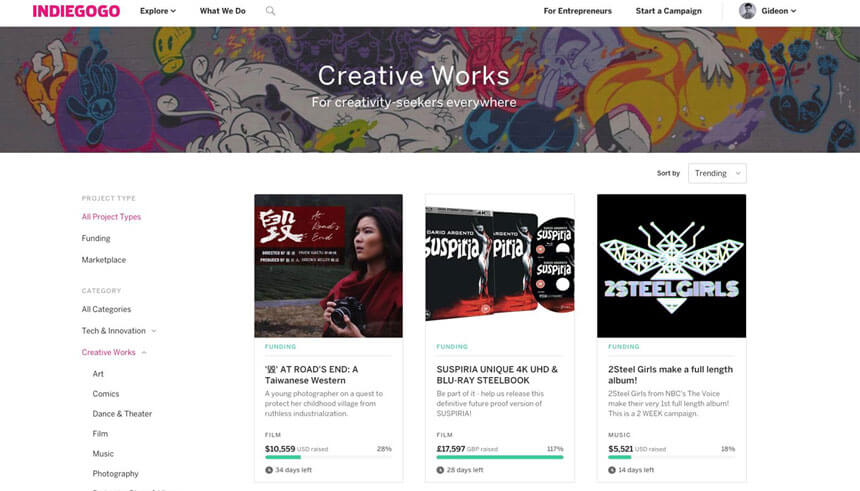

“I encourage everyone to ask themselves if a crowdfunding campaign is what their organization needs,” says Welles. “There’s a lot of prep work involved prior to launch, which can take time away from developing your product.”

After graduating from the University of Southern California with a major in film studies, Welles decided to dive head first into producing a movie in Taiwan, rather than staying in Los Angeles and working for Hollywood. “I jumped at the chance of studying Chinese in Taiwan, which was where I was born. I assumed that I would eventually go to Beijing or Los Angeles to pursue my career, but it was my travels in Taiwan that presented a unique opportunity to make a movie,” he says.

Crowdfunding, which essentially involves a large number of individuals to collectively finance a new business product or service, has been a more popular method of soliciting funds from the public. As long as the appeal is there, the sky is the limit.

While Welles and his team had a few solid investors who put funding behind their movie, they also launched a Kickstarter campaign to see if they could solicit money and support from friends. “For many people, it may seem like the easier option to raise funds, but don’t be easily swayed by some of these large campaign totals,” says Welles. “Most campaigns don’t meet their goal, and it’s hard work.” With an almost 24/7 level of commitment once the crowdfunding campaign launched, the team at Black Dragon Movie Corp. worked diligently to meet financial goals and deadlines.

“Do your due diligence on the people you are soliciting. Vetting goes both ways,” says Welles. “Given that time is your greatest resource, and that entrepreneurial projects are rarely short-term, also choose your partners wisely. Make sure that you are working with people who share the same values and definition of success that you do.”

SBA loans

A more traditional and direct approach to funding, small business administration (SBA) loans are still a popular method for businesses. Despite the funding landscape becoming more diversified with more access to funding tools, bank loans are preferred, since the method of securing a loan is much more straightforward.

“SBA loans are catered to small and growing businesses,” says Alex Kim, senior vice president and SBA sales manager at East West Bank. “The loan program provides financing for a variety of purposes, like purchasing a building or acquiring a new business, starting a new business, buying equipment, and providing much-needed operating capital.”

What’s important to note is the level of flexibility that each funding option provides. “SBA loans let borrowers acquire a building for as low as 10 percent down. I’m not aware of any other loan program that does that,” says Kim. SBA loans are startup-friendly with a guarantee fee that hovers close to 3 percent. Lower interest rates and longer repayment terms make it easier for small to mid-size business owners to make their monthly payments. “I like to tell my client to weigh out the pros and cons when they’re trying to determine the best funding option. I personally think that the SBA loan has a lot of pros for businesses,” says Kim.

In order to qualify for an SBA loan, businesses must have a solid credit score. While the exact score ranges depending on the lenders and lending amount, Kim says, “the average credit score range is typically around 700 to 720. Some institutions may consider extending credit if it’s lower than average.” In addition to this, most customers who were approved had an annual revenue of more than $1.5 million. “We’ve also made loans with revenues from the low hundred-thousands, up to $10 million or more,” continues Kim. “These are really just guidelines since we’re also here to finance startups under the SBA program.” Bank loan officers will also evaluate whether or not your business fits the criteria for an SBA loan based on other factors such as your business size, purpose and loan amount.

While soliciting for money is never an easy task, there are several options when it comes to choosing the funding method that best suits the needs of your business. Attracting the right investors who share the same visions and values are important for long-term commitment and growth. Once the platform and the people have been found, soliciting for money becomes a matter of strategy: Use various communication touchpoints to follow up with potential investors, give them a call-to-action, and remain polite but consistent and firm with the ask.

Subscribe to the Reach Further Newsletter

Get inspiring stories in your inbox every month.