U.S.-Asia Business

Food Delivery Services, a New Business Frontier

By Melody Yuan

Global business opportunities for food delivery in the US and China.

We’ve all done it. Whether it’s because of long days at work, busy schedules, lack of resources, or simply because it’s more convenient, we’ve all ordered from a food delivery service. There are many reasons for ordering your favorite foods online, and as more people opt to enjoy restaurant food from the comforts of their own home, more businesses are tapping into this trend.

As an active food delivery service user, George Wong passionately claims, “I don’t know what I would do without take out and food delivery. I’m terrible at cooking, and all me and my friends want to do is to play Counterstrike together, not to go out and eat.”

In 2015, consumer spending for food delivery in the U.S. was worth close to $30 billion, and a November 2016 survey indicating that about 20 percent of consumers use food delivery services at least once a week. According to Statista, pizza was the most popular cuisine being ordered for takeout in 2016, with 48 percent of diners stating that they enjoy using food delivery services.

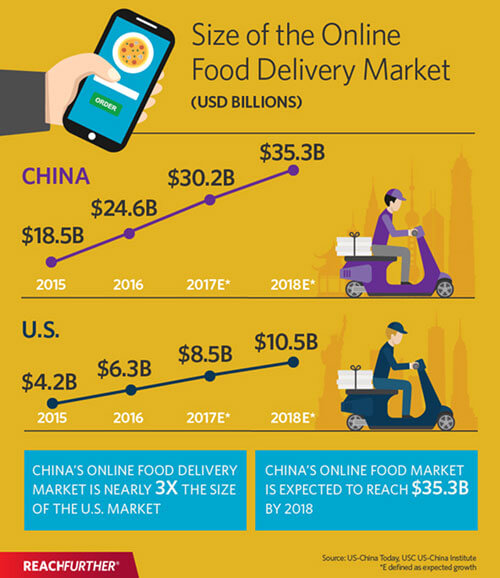

Likewise, China’s food delivery service industry is growing. Today, it covers 1,300 cities and feeds 346 million consumers, putting its market at more than $30 billion in 2017. Moreover, revenue from food deliveries shows a projected annual growth rate of 16.9 percent, resulting to a market volume of $90,491 million by the year 2022. These numbers indicate that the trend of consumers ordering food online is on the rise, and businesses are jumping in to capture this opportunity.

Finding a niche for your food service

“Coming up with the idea for my business was simple,” says Will Lin, cofounder of Gesoo, an Asian food delivery service business in Los Angeles. “There was no other competitor in the area that had a food delivery service catered specifically for the Asian market.”

Gesoo is a food delivery service that can be accessed online or through a mobile app. Their niche clientele is mainly Asian. “Gesoo is different from other food delivery services because most of the restaurants and vendors that we feature are Chinese. You don’t really see a whole lot of authentic Chinese restaurants being on food delivery service apps. We also have Japanese, Korean, Thai and Vietnamese cuisines in our service,” says Lin. With Uber Eats, Eat24, and delivery services from restaurants themselves as their biggest competitors, Gesoo is ahead of the game in capturing this niche market segment.

“We currently have more than 200,000 active subscribers who order food from our service at least twice a week,” says Lin. “Most are Asian millennials and typically college students who might be missing a taste of home.” Gesoo, from a business point of view, is an Asian food delivery service, but Lin emphasizes that the company strives to bring more awareness to the diversity of Asian cuisine to a wider consumer base.

In contrast to Gesoo’s niche segment, Chef Lala, who has routinely appeared on cooking shows and written cookbooks, has tapped into the Hispanic market. As a certified nutritionist who centers her food on health, Chef Lala has created a loyal following for her brand by engaging with customers while maintaining a presence on major television networks and shows, such as Univision, Telemundo, Dr. Oz and the Today show. As head and executive chef of the food delivery company, Chef Nourish, Chef Lala says that she is constantly aware of the cultural implications around the foods she prepares and delivers. “It’s a science trying to incorporate healthy meal prep into Latino culture food,” she says, “but it really boils down to the authenticity and how you cook it. Food is the most intimate piece of culture, and I use my brand to prove that we can have a healthy lifestyle and also preserve that culture in our food.”

Regardless of ethnicity, culture, or demographic, the number of consumers adopting food delivery services as part of their dining routine is increasing across the board. “Food delivery companies are doing well because of the convenience factor. Time is money,” says Chef Lala. “I have many high-performing clients who need to ensure that they are at their nutritional best without having to sacrifice time to advance their careers.”

China’s appetite for food delivery

China’s consumer appetite for food delivery can be described as voracious, as millions of people actively order online. Unlike in the U.S., where there are many business players in the food delivery service industry, the two biggest e-commerce businesses in China also dominate in the food delivery arena. Meituan Dianping, which is owned by internet giant Tencent, and Ele.me, which is supported by the equally large Alibaba, have a stronghold on the market. Servicing more than 1,300 cities around China, Meituan Dianping and Ele.me barter exclusive deals and discounts that they can offer customers in exchange for business. Consumers can also use apps such as Weixin (WeChat) to use and pay for the service in-app, making it much harder for newcomers to enter the food delivery service market.

“I think that, on average, 30 percent of the restaurant profits in China come from the internet,” says Lin. “The food delivery service demand there is much higher because internet companies and restaurants also entice people to order online using big discounts and coupons exclusive to food delivery.” More often than not, consumers ordering from Meituan Dianping or Ele.me can easily find bargain deals like ordering $20 worth of food for only $10. “We’re looking to expand our company, and we’ve discussed entering the China market,” says Lin. “But, to be frank, the e-commerce competition in China is incredibly fierce, and I think we’d have a better business advantage operating in markets outside of China.”

Emerging technology

To lower the overhead and liability costs of food delivery, companies are looking at technology as a viable solution. “The biggest cost for us right now is related to legal protection,” says Lin. “We want to make sure that we’re protected against any type of lawsuit, since there are always multiple parties involved with food delivery services. Whether it’s the restaurant, customer, food delivery staff, etc., we want to ensure that our staff is protected and that we can deliver the best results.”

Domino’s Pizza just began testing a human-free pizza delivery, in partnership with Ford Motor Co., and Toyota has unveiled its newest e-Palatte concept vehicle at the Consumer Electronics Show as a self-driving delivery car that will be used in conjunction with Amazon and Pizza Hut to launch a driverless delivery van service as early as 2020.

Seamless payment technologies are also jumping on the bandwagon, as apps like Cover give consumers the option of paying for your food through the app using Apple Pay or a credit card without having to ask for the check after dining. The app also allows diners to split the bill among one another and automatically calculates the amount owed to make the experience much easier.

The to-go cup half full

Despite food and beverage being a highly saturated market with fast turnover rates, the food delivery service offers unique new business opportunities. From finding niche consumer markets, to launching driverless food deliveries, companies are looking at ways to make the dining experience more personalized and convenient for the consumer.

The food delivery service industry is also becoming more sophisticated as the market matures. Delivery platforms in the U.S. are now storing relevant customer data, and cater food and menu options based on their previous food choices. With simple data such as knowing that 74 percent of delivery orders are placed on weekends, or that 82 percent of orders were placed from home, restaurants and delivery businesses are better able to prepare for consumer demand on any given day.

McKinsey & Company estimate that the global online food delivery market will grow by 25 percent per year from 2015 to 2018, and by 14.9 percent annually until 2020. “We’re looking to expand to other cities like San Francisco, New York and Toronto,” says Lin. “We want to grow internationally so that we can continue providing diverse Asian cuisines to consumers at the tap of their fingers.” Those already in the industry, like Gesoo and Chef Lala, are positioned favorably to generate more profit in the coming years if they play their cards right.