U.S.-Asia Business

China's SaaS Market has a Silver Lining

By Daniel Allen

With a growing number of Chinese enterprises migrating to the cloud, opportunities for international SaaS providers are multiplying.

Today, China's SaaS (Software as a Service) market is growing rapidly, offering lucrative opportunities for both savvy domestic and overseas players. It is still relatively small compared with North America and Europe, meaning there is plenty of scope for entrants with strong, locally adapted business models to leverage burgeoning demand and carve out market share.

"I would put China's SaaS market around 10 years behind the West right now," says Jonathan Brun, a Canadian who has run a Shanghai-based SaaS platform focusing on environmental, health and safety regulations since 2017. "But it's playing catch-up real fast."

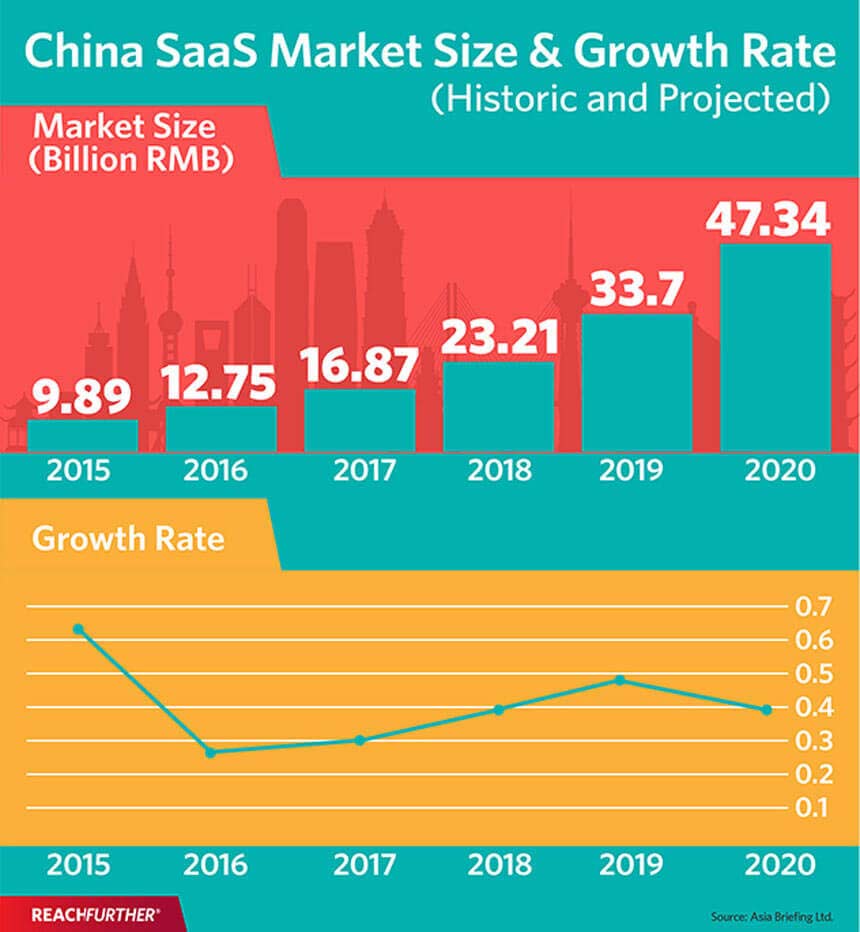

The development of the Chinese SaaS market has picked up pace since 2013. According to market data portal Statista, it will double its value over the period 2018-2020 to more than RMB47 billion (around US$6.7 billion). To put that in context, Statista predicts the global SaaS market will be worth US$157 billion by 2020, while Microsoft generated over US$10 billion in enterprise SaaS revenue in productivity and business processes in the second quarter of 2019 alone.

"I would put China's SaaS market around 10 years behind the West right now, but it's playing catch-up real fast."

Cloud conversion

Unlike in the West, where the first cloud customers were startups and then larger businesses, the Chinese cloud has grown out of consumer services. Cloud-based apps, games and software have long been the norm in the consumer sector, with tech heavyweights such as Alibaba, Tencent, Baidu and Dianping dominating the scene.

In the past, concerns over cost, security and logistics meant many Chinese businesses were reluctant to migrate to the cloud. Chinese companies are extremely sensitive when it comes to their data, with the vast majority still preferring it to be stored in-country.

However, encouraged by decreasing costs and Chinese government policy, a growing number of Chinese firms, unhampered by decades of outdated IT infrastructure, are now adopting cloud-based alternatives to on-site enterprise hardware and software. This is especially the case with China's burgeoning number of SMEs, which typically have smaller budgets and therefore prefer the lean business models supported by SaaS. Customer relationship management software (CRM), office automation software (OA), intelligent manufacturing software (IM) and office collaboration software top their shopping lists.

"SaaS has become the leading enterprise software delivery model of choice in China," says Ciaran O'Keeffe, senior business development advisor at Asia Market Entry, a Singapore-based company which helps international software and technology companies expand into Asia.

"This is being driven by similar trends we see in Western markets—an increasing desire for managed, regularly upgraded services, outsourcing of IT functions, and access to world-class security standards provided by China's leading cloud-platform providers, such as Alibaba, Tencent, Microsoft, Amazon Web Services (AWS) and Baidu," O’Keeffe explains.

Fragmented market

In terms of SaaS providers, the Chinese market is highly fragmented. The largest player is Shenzhen-based outfit Kingdee, which for many years was a traditional software provider, that has a market share of just over 7 percent. The top 10 companies in terms of market share account for just over a third of the market.

Many of China's SaaS market verticals boast far more domestic than international providers.

"Kingdee is a leading provider of HR (human resources), ERP (enterprise resource planning) and accounting software, as are ForceClouds and MacroWing, who provide document and data management tools to the clinical research, pharmaceutical and medical device industries," says O'Keeffe. "Companies such as Beisen and DOIT have partnered with market giants such as Tencent to provide leading CRM solutions."

"There is certainly stiff competition from domestic SaaS providers in China," adds Brun. "In the West I might have one or two legitimate competitors, whereas in China I could have five or six."

Such competition is set to stiffen as Chinese companies become more sophisticated in using cloud technology and data to provide services to customers, as well as for their back office needs. The last few years have seen a whole host of Chinese SaaS startups founded, with services related to everything from education and health care, to finance and logistics.

"Chinese SaaS companies are quickly reaching global 'best-of-breed' status," says O'Keeffe.

“SaaS has become the leading enterprise software delivery model of choice in China”

SaaS with Chinese characteristics

For international SaaS providers, negotiating the idiosyncrasies of the Chinese market is far from straightforward. For starters, a long-established government policy of supporting domestic champions encourages Chinese companies to do business with the likes of Alibaba, Baidu and Tencent, tilting the playing field.

According to Chinese regulations, SaaS software must be located on a server in China, while foreign firms are barred from owning internet content provider licenses. This means that overseas SaaS companies that want to operate in China must provide their services through Chinese partners who manage the critical relationships between buyers and suppliers.

Such partnerships are exemplified by the recently announced collaboration between Alibaba and U.S. cloud software company Salesforce. This has seen the e-commerce giant become the exclusive provider of Salesforce services to customers in mainland China, Hong Kong, Macau and Taiwan.

Despite the challenges of SaaS market entry, the potential rewards for those foreign firms that succeed still make it a compelling proposition. Given China's ongoing transition to a higher value-added economy, its burgeoning startup scene and its desire to establish global supremacy in all things tech, cloud industry experts fully expect China to be the largest market for cloud services in the not-too-distant future.

Although a sizeable chunk of China's SaaS market is already serviced by the likes of Microsoft, Oracle and Salesforce, opportunities will grow for international SaaS vendors who have teamed up with domestic providers, and who have well-established, fully localized products.

"As Chinese enterprises continue to migrate existing on-site or hosted electronic systems to the cloud, they will be searching for best-in-class solutions," says O'Keeffe. "I'd say the most lucrative sectors for international SaaS providers going forward will be Big Data Platforms, Integrated Data Management, Data Warehouse Platforms and ERP."

Going local

For international SaaS providers, building a strong business relationship with a local partner can be instrumental in the development of sales strategy, as well as the alleviation of taxation and administrative burdens.

Yet the challenge of making it big in China's SaaS market doesn't end with identifying the right partner. What you're selling and who's selling it are just as important. Software localization is absolutely essential, which is something talented Chinese personnel can assist with.

"Hire local staff, not expats, and give them the latitude to make decisions," says Brun. "Joint ventures need Chinese leadership—people who have a vested interest in the success of the business.”

He continues, "Don't try to shortchange anyone, and always play by the rules. If the service you're selling aligns with the ambitions of the Chinese government, you're far more likely to achieve success."

Mike Vinkenborg, a project leader working for China-based consultancy Daxue Consulting, counsels the need for patience and an ability to withstand financial pressure.

"A lot of Chinese companies have very aggressive business strategies," says the Shanghai-based SaaS specialist. "This essentially involves making huge losses while they build their customer base, and then sometimes going straight to an IPO."

Top Chinese SaaS provider Kingdee is a case in point. While revenue from its cloud business reached $78 million in the first six months of 2019, an increase of over 50 percent year-on-year, the company is still reporting losses due to high operating costs.

Brun agrees on the need for deep pockets. "Since we began operating in China, we have learned that running SaaS in China is not as hard as you might think, but it does require additional resources," he says. "The initial approach of many Chinese providers is to bleed money while they grab market share. Foreign providers need to understand how this can negatively impact their pricing and revenues."

Future focus

China's SaaS vendors will continue to invest in technology that can help them leapfrog their Western counterparts, with the rise of Smart Manufacturing driving opportunities for embedded IoT (Internet of Things) solutions. With an ever-greater need to reduce the environmental footprint of Chinese industry, SaaS and IoT solutions that enable better management of resources and minimize waste will become widespread, driven by government regulation.

Perhaps even more importantly, China's rapidly growing online consumption will continue to intensify demand for AI-enabled chatbot and customer service provision. This is exemplified by the popularity of Alibaba's sophisticated customer service chatbot, Alime, which the Chinese e-commerce giant says can help merchants halve their previous call center costs.

"When it comes to customer service, the Chinese probably have the highest expectations in the world," says Vinkenborg. "For many Chinese companies, AI-enabled, increasingly intelligent chatbots are the cheapest and easiest way to handle high-volume customer interaction."

Underpinned by the continued rollout of the cloud, China's SaaS market will keep evolving. As Chinese enterprises become ever bigger SaaS consumers, international providers will not only need to master working with domestic partners, but stay abreast of the rapidly shifting tech to tap that fiercely contested silver lining.