US-Asia Business

US-China Market Watch: Diplomatic Row, Qualcomm Inks Deal with Huawei, China’s Cinemas Reopen

By Angela Bao

Your monthly roundup of the latest US-China business and industry news.

U.S.-China political tensions rise, trade deal remains stable

Tensions between the United States and China have been on the rise. Recently in a tit-for-tat move, China shut down the United States’ Chengdu consulate, after U.S. officials accused Chinese diplomats of espionage and ordered the closure of China’s Houston consulate. The U.S. also banned 11 new Chinese companies from buying American technology. Hong Kong has also become a point of contention, with China passing a national security law that would bring the city-state more closely under Chinese control.

Despite the political tensions between the United States and China, the phase one trade deal has become a source of stability. Neither the U.S., nor China have made any recent threats or remarks about dismantling the deal, which The New York Times posits as both sides realizing they have more to gain from keeping the deal intact. In July, China also made its largest single-day purchase of 1.7 million tons of U.S. corn, which could make the 2020-21 marketing year the second-largest annual volume exported.

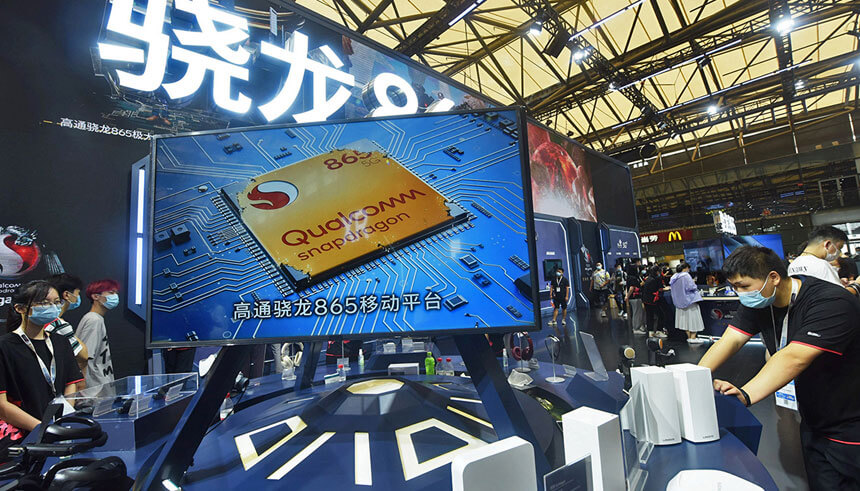

Qualcomm and Huawei ink licensing deal

U.S. chipmaker Qualcomm announced at its earnings call that it had inked a two-part deal with Chinese telecommunications Huawei. The deal resolves a dispute with Huawei, for which Qualcomm will receive a lump payment of $1.8 billion in unpaid licensing fees, and includes a multi-year agreement for Huawei to license Qualcomm’s technologies. Qualcomm CEO Steven Mollenkopf said that the deal would drive a significant increase in sales for the company.

The announcement comes despite political tensions between the U.S. and China. The Trump administration had placed a number of restrictions on Chinese firms using U.S. technology, due to national security concerns. Although the restrictions limit the sales of physical chips to foreign firms, it doesn’t affect licensing agreements.

China reopens movie theaters

On July 20, China began reopening movie theaters in “low-risk” areas, after remaining closed for about six months due to the coronavirus pandemic. By the end of the first week, approximately 4,900 cinemas, or 44 percent of China’s total, had reopened, with capacity capped at 30 percent and other safety measures implemented, such as prohibiting eating and drinking within theaters.

The box office totaled $12.6 million in its first weekend open, with Hollywood titles rounding out five of the top 10 films. Universal’s “Dolittle” and Sony’s “Bloodshot,” starring Robert Downey Jr. and Vin Diesel, respectively, were the top two films. Most of the other movies that played during the reopening weekend were re-releases of older titles, such as Pixar’s “Coco” (2017) and locally produced spy thriller “A Message” (2009).

Apple could gain a mainland Chinese iPhone maker

After purchasing Taiwan-based Wistron Corp.’s iPhone production business for $472 million, China-headquartered Luxshare Precision Industry Co. could become the first mainland Chinese company to produce Apple iPhones. The deal is supposed to be completed by the end of 2020, pending regulatory approval.

Luxshare, which is already the world’s biggest manufacturer of Apple AirPods, bought two of Wistron’s subsidiaries in eastern China, with one of those units being Wistron’s only iPhone manufacturing site. Wistron is the smallest of Apple’s three iPhone assemblers, with the other two being Pegatron Corp. and Foxconn, both Taiwan-based companies.

Chinese EV startups seeking U.S. IPOs

In a bid to ramp up capital, two Chinese electric vehicle (EV) startups announced plans for U.S. public offerings. Xpeng Motors, which currently sells two models, reportedly made a “confidential filing” for a U.S. listing and is expected to raise over $500 million. Back in November, Xpeng had raised $400 million in funding, which valued the startup at around $4 billion, and is reportedly seeking an additional $300 million in funding prior to its U.S. IPO.

Li Auto is also aiming to raise $950 million in its U.S. IPO on Nasdaq, which will be one of the biggest listings by a Chinese company this year. NIO, another New York-listed Chinese EV startup, has tripled the value of its stocks this year.

Despite rising trade tensions, investors seem keen on jumping into the EV boom. Tesla recently became the world’s most valuable carmaker, overtaking Toyota, Volkswagen and Hyundai in combined market value.

JPMorgan and Ping An back a supply chain fintech startup

A group of global investors, which is led by China’s Ping An Insurance Group and includes JPMorgan, is putting $60 million into Taulia Inc., a San Francisco-based fintech company that facilitates payments between companies and suppliers. The Wall Street Journal posits that the interest comes on the heels of the COVID-19 pandemic, which has disrupted global supply chains and led some suppliers to demand early payments to maintain liquidity.

Taulia provides an online platform that allows suppliers to send in their invoices to be paid by their buyers. The suppliers can opt for early payment, which would then be paid out by the buyers themselves or by third-party financial institutions.

Taulia, whose clients include Nissan and Airbus, currently has over 2 million suppliers signed up and financed more than $7.5 billion invoices last quarter.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.