U.S.-Asia Business

Dominic’s Take: Striking the Right Balance in the US-China Relationship

By Dominic Ng

East West Bank CEO lays out a clear case for striking the right balance between economic growth and security in the U.S.-China relationship.

At the virtual meeting between Presidents Biden and Xi last month, the two leaders took steps to stabilize the relationship. By finding common ground on climate change, relaxing restrictions on journalist visas, and setting guardrails to prevent armed conflict, the two leaders are making efforts to manage the relationship despite differences.

But debates in Washington over the right level of openness toward China are nowhere near settled. Many Trump-era barriers remain in place, and even more are being discussed in Congress.

To coexist and compete with China, we need to be clearheaded about how to balance the dual needs of economic growth and security. Finding this balance will not be easy, but there are steps we can take now to make the challenge easier.

It starts by recognizing that American workers benefit from trade and investment with China. Exports to China support more than 1.2 million US jobs. Chinese companies invested in the US directly employ nearly 200,000 Americans. US businesses’ presence in China drives growth, revenue, and innovation—boosting jobs back home. Preserving these ties is critical to keeping inflation low, employment high, and the economy humming.

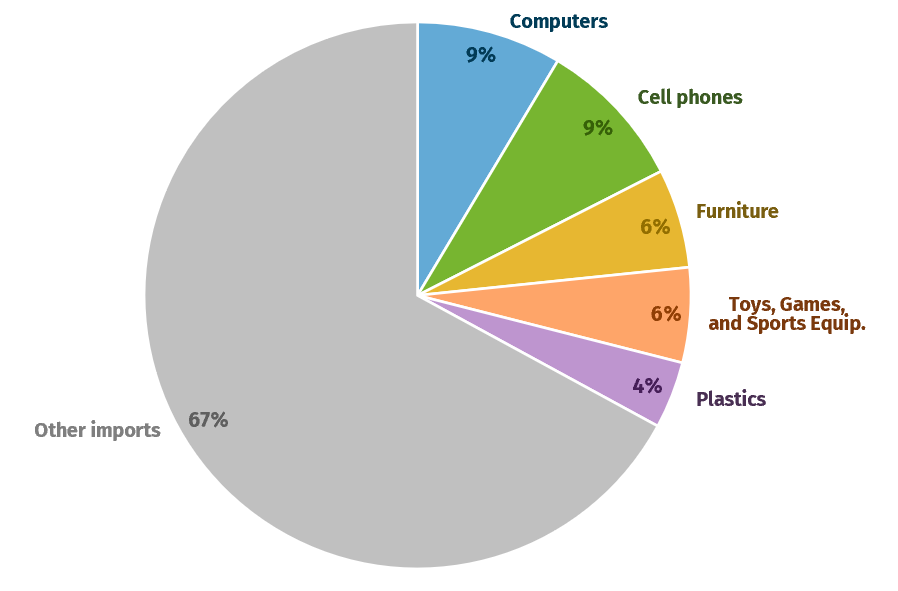

The next step is understanding that despite the rhetoric, the bulk of US-China economic engagement is irrelevant to national security concerns. It is easy to forget that the top five categories of US imports from China are consumer goods: computers, cell phones, furniture, toys, and other plastics. These goods alone comprise a third of US imports from China.

US Imports from China by Product Category, 2019

When you consider all the other non-sensitive things we import from China, that figure grows even larger. A recent study commissioned by the German Bertelsmann Foundation found that over 80% of EU imports from China and over half of EU exports to China have no national security relevance at all. By identifying and setting aside these sectors from security debates, we can make the challenge smaller and focus on real threats.

Even in sectors where there may be potential risks, the US has tools to mitigate concerns. The Committee on Foreign Investment in the United States (CFIUS), for instance, evaluates national security threats from foreign investment. While the committee can block deals outright, it can also propose mitigation measures to address possible issues, such as ensuring that only authorized people have access to certain technology or excluding sensitive assets from transactions.

These measures make a difference. Of the 88 deals the committee investigated in 2020, nearly 20% were able to pass after some mitigation efforts were put in place. In only 8% of cases did investors abandon their transaction after the committee found no way to resolve the national security risks around the deal. These kinds of rules help address possible national security concerns while keeping the US open for business.

Under the last administration, efforts to address national security risks were often ad-hoc and muddled. One needs to look no further than the market confusion caused by President Trump’s effort to extort TikTok to see why formal processes for addressing these challenges are so critical. That is also why it is important that President Biden has reiterated America’s pledge to treat investors fairly and keep the US open for business.

Looking ahead, it is crucial that policymakers take a reasoned approach toward new proposals to regulate economic ties with China. Some proposals, such as a bill to screen US investment abroad, are potentially far-reaching and could undermine US competitiveness abroad without great benefit to national security.

Policymakers should remember that the US benefits greatly from its economic ties abroad, including to China. In most cases, there is no trade-off between keeping America’s doors open and preserving our national security. Dealing with what risks do exist requires a scalpel, not a sledgehammer.

The stakes are high. At a time when the global economy remains under pressure from new COVID variants and supply chain disruptions, it is more important than ever that we strike the right balance with our trade and investment partners.