U.S.-Asia Business

US-China Market Watch: Indo-Pacific Economic Pact, Shanghai Reopens

By

Your monthly roundup of the latest US-China business and industry news.

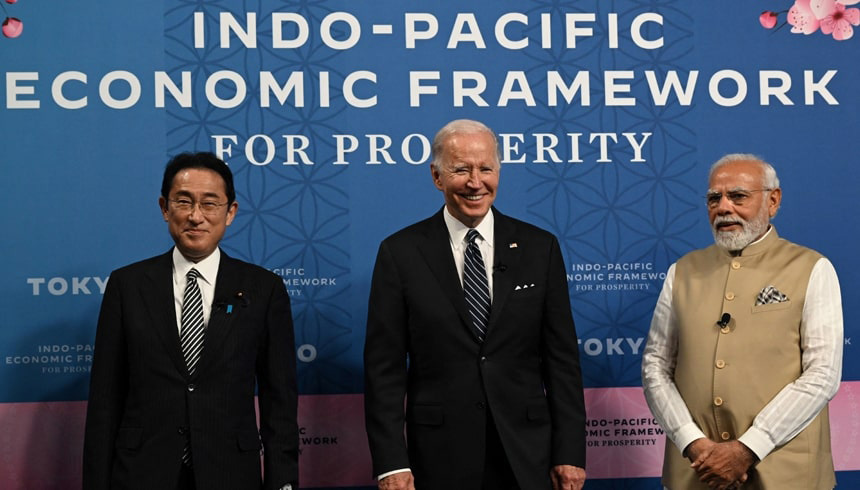

Biden announces Indo-Pacific economic pact

On his first presidential trip to Asia, President Joe Biden announced the launch of the Indo-Pacific Economic Framework for Prosperity (IPEF), which is aimed at countering China’s presence in the region. In a speech made in Tokyo, President Biden said that the framework aimed to deliver a “vision of the Indo-Pacific that is free and open, connected and prosperous, and secure as well as resilient, where economic growth is inclusive for all.” According to U.S. Commerce Secretary Gina Raimondo, the pact is meant to give countries in the region an alternative to China’s influence, as well as restore “U.S. leadership in the region.”

The framework includes 13 countries: major economies in the region such as Japan, South Korea, Australia, and India, as well as Singapore, New Zealand, Malaysia, Indonesia, Thailand, the Philippines, and Vietnam, among others. Altogether, they make up about 40% of global gross domestic product.

Just days after President Biden’s announcement, China held its own high-level discussion of the Regional Comprehensive Economic Partnership (RCEP), which was signed by 15 countries in 2020 (including ones in IPEF) and is the world’s largest trade deal. According to analysts, China’s move was in line with expectations to continue pursuing existing trade pacts and expanding its influence in the region, instead of specifically targeting IPEF.

Shanghai reopens after two-month lockdown

After a two-month COVID-related lockdown, the Chinese government has eased its stringent restrictions on Shanghai and its 25 million residents. As a result, stocks rallied, and Goldman Sachs expects a strong economic rebound in June and July. However, experts warn that a full economic recovery is still a long way off.

Shanghai is the world’s largest shipping port and the economic center of China. The lockdown led to severe negative impacts on domestic and international businesses, shut down factories, and caused global supply chain delays. In April, Shanghai’s industrial output shrank by more than 61% compared to the same period last year.

Despite the relief over Shanghai’s reopening, some foreign businesses are reconsidering their China operations, due to possibilities of another COVID outbreak and subsequent lockdown.

China to close Didi cybersecurity probe

After a nearly year-long review, Chinese regulators are set to conclude their cybersecurity probe into Chinese ride-hailing company Didi Chuxing, which would allow the company to return to app stores in China. The move signals Beijing’s easing of its tech crackdown, which saw numerous companies face fines, probes, and restrictions.

The cybersecurity probe came just days after Didi’s blockbuster listing on the New York Stock Exchange, which raised $4.4 billion. The government ban wiped out almost 90% of Didi’s market cap, decreasing from $70 billion to just about $9 billion now.

Chinese authorities will levy a fine against Didi and receive 1% in company equity. Didi will also continue its delisting from the NYSE, after shareholders voted overwhelmingly in favor of it. According to the company, the delisting is required to conclude the cybersecurity review.

Deliveries of electric vehicles in China rebound

Despite COVID-19 lockdowns, Chinese electric vehicle makers Nio, Xpeng, and Li Auto’s vehicle deliveries rebounded in May.

Nio’s deliveries rose 38% from the previous month to over 7,000, after a reaching a six-month low in April, and plans to accelerate deliveries in June based on strong order demand. Li Auto said its deliveries more than doubled from April to almost 11,500 units, and Xpeng said its deliveries increased 12% to 10,125 vehicles.

North America to beat China as world’s biggest box office

North America is set to once again become the world’s largest box office. For the past two years, China beat out North America for the title, but COVID-19 lockdowns in the mainland combined with growth in other markets.

According to U.K. research firm Gower Street, China is tracking 37% behind 2021. Hong Kong, Taiwan, and Russia are also tracking behind 2021 numbers. Globally, however, box office revenue is 60% ahead when compared to the same period last year.