Secured Credit Card

Establish Your Credit Today

Perfect for students, new immigrants or foreign nationals who maintain a U.S. residence. Start building your credit history.1

The East West Bank Secured Credit Card can help you establish a good credit rating when used and managed wisely. Secured cards work much like any other credit card, but require collateral to get started.1,2

| Bank of America | Citibank | |

| Apply with no SSN | |||

| Maximum Credit Limit | $10,000 | $5,000 | $2,500 |

| Annual Percentage Rate (APR) | 20.99% | 26.24% | 27.74% |

| Foreign Transaction Fee | No fee | 3% | 3% |

East West Bank information accurate as of 02/01/2024. Information from other listed institutions is from the institutions’ websites, and is accurate as of 12/04/2023. The data listed above may change, and additional features and terms may also apply to each institution’s secured card product.

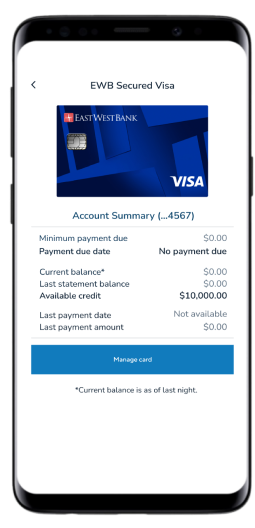

Apply for the Secured Card in our Mobile App or Online Banking service.2

If you don’t already have the Mobile App, download here.4

When you submit your application, you will need to provide a refundable security deposit equal to your chosen credit limit. You can close your credit card account any time and get your security deposit2 back.

Give us a call at

877-578-0685

Mandarin and Cantonese Support

Mon - Fri: 8:30 am to 5:30 pm PT

English and Spanish Support

24/7, 365 days a year

1We may report information about the status and payment of your account to credit bureaus and other creditors. East West Bank will report this information using the available personal identifying information you have provided to us or provide to us at a later date. You can learn more about how we report Credit in your Secured Visa® Classic Credit Card Agreement.

2Funds equal to your chosen credit limit must be deposited into your primary checking account and pledged to East West Bank as a security deposit before your application can be processed. If your credit application is denied or withdrawn before approval, the security deposit will be released within three business days. If your credit application is approved, the secured deposit will not be available for your use until the card is closed and the security deposit is released by the Bank. Please refer to the Secured Visa® Classic Credit Card Agreement and Terms and Conditions for additional details.

3East West Bank does not charge a fee for you to conduct transactions in currencies other than U.S. dollars, although transactions conducted in a foreign currency are converted to U.S. dollars by Visa®. For more information about how this occurs please refer to your Secured Visa® Classic Credit Card Agreement.

4East West Bank does not charge for Mobile Banking. However, your mobile service provider may charge for sending and receiving text messages on your phone. Check with your service provider for details on specific fees and data charges that may apply.

1 We may report information about the status and payment of your account to credit bureaus and other creditors. Back to reference

2 Funds equal to your chosen credit limit must be deposited into your primary checking account and pledged to East West Bank as a security deposit before your application can be processed. Back to reference

3 East West Bank does not charge a fee for you to conduct transactions in currencies other than U.S. dollars, although transactions conducted in a foreign currency are converted to U.S. dollars by Visa®. Back to reference

4 East West Bank does not charge for Mobile Banking. However, your mobile service provider may charge for sending and receiving text messages on your phone. Back to reference