Entrepreneur Insight

PPP Second Draw: What You Need to Know

By Angela Bao

Overview of the new terms and eligibility requirements for PPP Second Draw

On December 27, 2020, President Donald Trump signed another round of COVID-19 relief aid into law. The $900 billion package extends unemployment benefits, includes a round of $600 stimulus checks, and creates a $15 billion grant program for theaters, museums and live venues that lost revenues due to COVID-19, among other things.

The bill also includes $284 billion in additional Paycheck Protection Program funding, known as the PPP Second Draw, to help small businesses stay operational and keep workers on payroll. Both new borrowers and previous PPP borrowers are eligible, as long as they meet the new requirements. The SBA has released initial guidance and here are some key provisions that have been outlined in the PPP Second Draw so far.

Overview of PPP Second Draw

Although the PPP Second Draw has new restrictions on eligibility, most of those do not affect the forgiveness for businesses that took out loans in the first round, says Matt Vondersaar, first vice president and credit supervisor at East West Bank. However, for businesses seeking to get a loan from the PPP Second Draw, some of the requirements have changed.

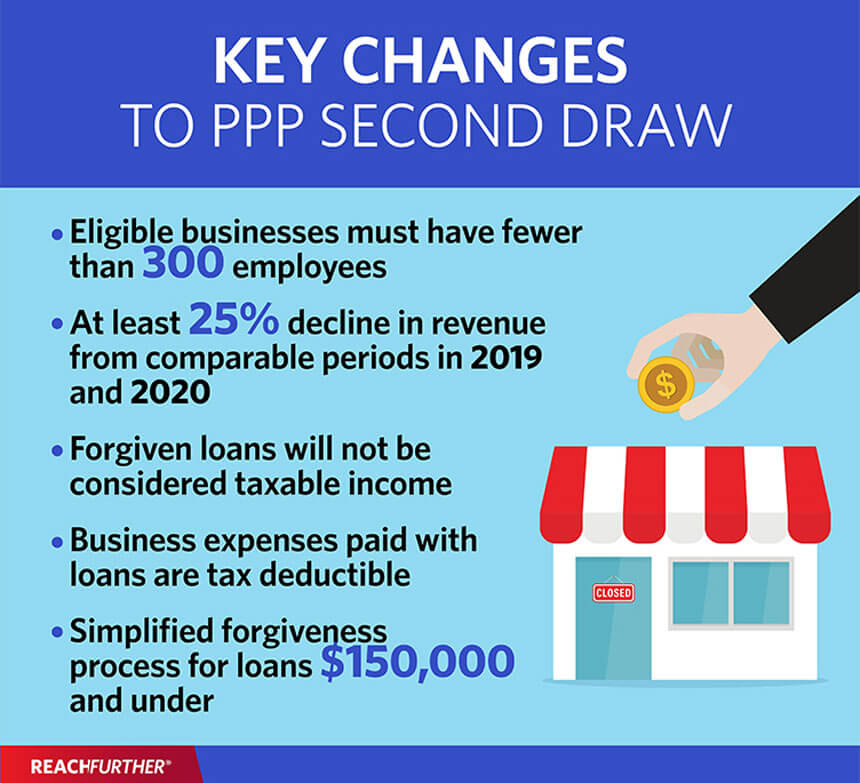

Here are some of the key changes:

- Businesses can have no more than 300 employees (in the first round, the maximum size was 500 employees)

- PPP Second Draw also eliminates the alternative size standard for a business’s NAICS code

- Businesses must have suffered at least a 25% decline in gross revenues between comparable quarters in 2019 and 2020

- Certain housing cooperatives, certain 501(c)(6) nonprofits and news/media organizations (which have a size limit of 500 employees) now also qualify

- The covered period can be any amount of time between the eight weeks or 24 weeks after loan origination (for example, businesses may opt to use a 13-week covered period)

- EIDL Advances are no longer deducted from the forgivable PPP amount

- A forgiven loan will not be considered taxable income

- Congress has also clarified that businesses can take normal business tax deductions for expenses paid by the PPP loan

- Simplified forgiveness process for loans of $150,000 and under

The new loans are also more limited in size, with a maximum loan size of $2 million, compared to $10 million in the first round. However, Vondersaar notes that “this (second loan) is available even if your borrower has already received a $10 million PPP loan; they can get another PPP loan for up to $2 million.” The maximum loan size that a business qualifies for will still be calculated as 2.5 times their average monthly payroll, he adds.

However, under the PPP Second Draw, businesses in the accommodations and food services sectors calculate their loan qualification size differently. “If you're in that sector with the NAICS code starting with 72, then the average will be 3.5 times your average monthly payroll,” says Vondersaar. “So those folks get another month, essentially, of payroll for their loan amount.”

Forgivable expenses

The PPP Second Draw still requires 60% of the loan be spent on payroll expenses, but the law has expanded which expenses qualify.

“Everything's the same except that they've made it clear that you can include employer-paid life insurance, disability Insurance, vision and dental,” says Vondersaar.

For non-payroll costs, the bill added new items such as business software and cloud computing expenses for payroll, HR and accounting of inventory. Vondersaar adds that businesses that were damaged during the 2020 protests can also use PPP funds to cover those costs, but only if those damages were not covered by insurance or other forms of compensation.

Association with China and/or Hong Kong

One of the strictest changes was that the new bill specifically called out businesses with ties to China and/or Hong Kong as ineligible for the PPP Second Draw. However, because it wasn’t stated in the first round of PPP, businesses that have such ties and received a loan the first time are still eligible for forgiveness, says Vondersaar.

“It includes companies with significant operations in one or both areas (China and Hong Kong),” he explains. Although there isn’t currently much definition over what constitutes as “significant operations,” Vondersaar says that it could mean businesses that have a warehouse or factory facility in China or Hong Kong, or if a substantial part of their business is dependent on those regions.

Additionally, any company with even partial Chinese ownership or association is ineligible. “Anytime you have a Chinese company or a Chinese owner who has directly or indirectly 20% of the economic interest of that business concern, then that company is not eligible for the Second Draw loan,” says Vondersaar. “And any company that retains a board member who is a resident of these areas is not eligible.”

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.