US-Asia Business

Now Is the Right Time to Invest in China, Not Withdraw

By Dominic Ng

East West Bank CEO Dominic Ng says recent reforms have improved market access for US companies in China, and should be addressed in US-China negotiations.

When Presidents Trump and Xi meet at the G20 Summit at the end of November, tariffs will top the agenda. Vice President Mike Pence has threatened to “more than double” the $250 billion in tariffs on Chinese goods at the Asia-Pacific Economic Cooperation summit, despite a list of trade concessions offered by Chinese officials in recent days. But trade is not the sole dimension of the U.S.-China economic relationship, nor is it the only avenue for pursuing the national interest. One area that is not getting the same attention is China’s treatment of foreign investors. China has recently made tangible progress in further opening its economy to foreign investment, and American companies like Tesla and Exxon are among the ones taking advantage of this. This facet of our engagement with China is critical to achieving the free, fair and reciprocal relationship Washington aspires to, and deserves an important place at the table.

China has overhauled its FDI regime

While China still does not have the same openness to foreign investment seen in advanced economies such as the United States, it made significant improvements in the past three years, with positive results for foreign companies. For one, it has moved from a “positive” to a “negative” list approach. Under the previous system, foreign firms were only allowed to invest in sectors that were on a positive list of “encouraged” sectors, and every investment required approval by the government. Those approvals were often coupled with formal restrictions (for example, requirements to enter a joint venture) or informal expectations (such as sharing technology). Under the new regime, adopted in 2016, foreign firms are now by default allowed to invest in every sector, unless it is specifically mentioned on a negative list of restricted sectors. Moreover, for sectors not on those lists, firms do not have to apply for approvals anymore but are merely required to register their investments.

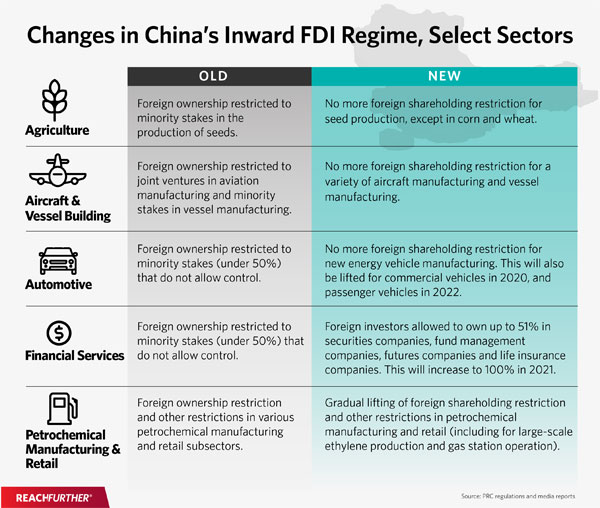

The second notable change in China’s inward FDI system was a significant reduction of the sectors on that negative list and related restrictions. The number of restricted or prohibited sectors on the negative list decreased from 93 in 2016 when the system was first implemented, to 63 in 2017, and just 48 in 2018. Many observers are unsatisfied with this still extensive list—and indeed, much work remains—but this is a significant move forward. The situation has improved markedly in many sectors that are relevant for American companies, including electric vehicle production, aviation manufacturing, and certain financial services and agriculture activities. If continued, it will get China to where it needs to go.

“While China still does not have the same openness to foreign investment seen in advanced economies such as the United States, it made significant improvements in the past three years, with positive results for foreign companies.”

U.S. companies are seizing new opportunities

While there is a lot of cynicism in the foreign business community regarding implementation of the more liberal rules, Beijing is taking those steps seriously. The best evidence is that, despite saber-rattling by politicians and talk about de-coupling, U.S. companies are in fact expanding their investment into China.

According to China’s Ministry of Commerce, American FDI in China was up more than 10 percent for the period of January to September 2018 compared to the previous year, and I see great appetite by U.S. companies to increase investment in areas that Beijing has recently liberalized.

One high-profile example is Tesla, which has begun building a $2 billion wholly-owned electric vehicle factory in Shanghai. The factory will produce up to 500,000 Model 3 and Model Y cars per year for the Chinese and global markets. This will be the first foreign-controlled auto plant in the PRC, made possible by recent reforms to abolish restrictions on foreign majority ownership. Other foreign automakers are already following suit and acquiring majority control of their existing China joint ventures, such as Germany’s BMW.

Another example is the petrochemical sector, where China has gradually lifted restrictions since 2011 and now allows foreign-controlled manufacturing facilities. That has led to Exxon Mobil considering a multi-billion-dollar petrochemical complex in Guangdong to produce petrochemical materials to meet growing demand in Asia. Exxon would be following BASF, a German conglomerate, which earlier this year announced a $10 billion investment in China’s first wholly foreign-owned heavy chemicals complex, also in Guangdong.

Finally, U.S. companies are also poised to take advantage of recently announced changes in the financial sector. In April 2018, China committed to allowing foreign companies to take controlling stakes in asset management and securities firms (51 percent immediately and 100 percent in three years). Many firms are in the process of seizing that opportunity by taking control of their existing securities joint ventures, including J.P. Morgan and Morgan Stanley. This will position them better to serve China’s growing demand for wealth management, brokerage and other services.

FDI reforms show a way out of current escalation path

Of course, these initial data points are not enough for a final verdict on Chinese FDI reforms. Neither will these steps be enough for resolving existing U.S. concerns about the lack of reciprocity in market access. However, the reforms and the response by foreign companies are much needed good news amidst the current doom-and-gloom outlook.

The reforms show that China understands that overhauling outdated approaches to create a more level playing field for foreign companies is ultimately beneficial for its own long-term prosperity. It also demonstrates that honest reform efforts with high-level buy-in can produce real change in the marketplace. The switch to a new approach is making a tangible difference for foreign companies in the affected sectors and is changing the way those companies think about long-term prospects in the Chinese market.

The opportunities presented by China’s progress on the direct investment front deserve an important place in the conversation between Presidents Trump and Xi. Toughness is not an end in itself: It is a means to a mutually prosperous and constructive end.

This editorial first appeared on the South China Morning Post.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.