US-Asia Business

Dominic’s Take: How Americans Can Benefit from Chinese Innovation

By Dominic Ng

East West Bank CEO Dominic Ng says it would be a mistake for the US to shut the door to Chinese technology.

In his State of the Union Address, President Trump expressed concern that “rivals like China” are challenging U.S. interests, values and the economy. This rhetoric is characteristic of the adversarial climate that has taken root in the United States, fostering an atmosphere of anxiety and fear for technology cooperation with Chinese firms. Congress is considering new legislation to expand the U.S. investment screening regime to restrict Chinese firms from accessing potentially sensitive U.S. technologies, and the Trump Administration is reportedly preparing harsh penalties for alleged forced technology transfers to China as part of the Section 301 trade investigation.

Our leaders need to address legitimate concerns related to Chinese innovation practices that have the potential to harm the U.S. economy and security. However, we should take a nuanced and measured view, being careful not to blindly heed hawkish voices advocating for a wholesale ban on Chinese technologies. The cost of shutting the door would be high for everyone, including the United States, and this cost must be weighed when considering any policy decisions.

Consider some of the everyday technologies the U.S. now enjoys, thanks to a long history of open engagement with Japan. Had the United States allowed anxieties about Japan’s rise in the 1980s to lead to a closed-door policy towards Japanese technologies, the U.S. might have missed out on just-in-time value chains, iconic products like the Sony Walkman, Toyota Prius or the pocket calculator, and critical electronics technologies like the LED components that are behind modern television and computer screens. Who knows what iconic, disruptive innovations will come from China in the next decade?

The cases of mobile payments, biotechnology, and transit infrastructure illustrate what U.S. consumers stand to lose if we close our markets to Chinese innovation.

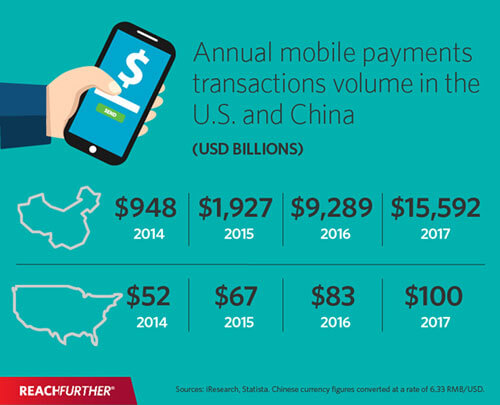

Mobile payments

Mobile payments technologies and adoption rates are leagues ahead in China, compared to the U.S. Most people in Chinese cities use smartphones and QR codes to pay for nearly everything, from restaurant meals, to utility bills. China’s two leading platforms—Alibaba’s Alipay and Tencent’s WeChat Pay—are so widely used, even panhandlers accept donations through smartphone payments. China’s mobile payments transactions topped $9 trillion in 2016, or roughly 100 times the size of America’s market. Most of this remarkable growth has happened within just the last few years.

Why did this thriving cashless transactions ecosystem develop in China instead of the U.S.? For one, China has a massive population with rapidly increasing smartphone and mobile internet penetration rates. There were more than 600 million smartphone users in China in 2016, or about twice the population of the United States—a critical ingredient to realizing network effects. But perhaps even more importantly, traditional credit card systems never fully took root in China, allowing China to leapfrog directly to mobile. U.S. incumbents Visa and Mastercard have had little incentive to disrupt their own highly profitable revenue streams at home, and their antiquated payments systems are functional enough to discourage a homegrown payments revolution. China simply had the right conditions for mobile payments to take root and lacks the institutional barriers in the U.S.

China’s tech giants are now looking to take their mobile payments systems abroad. Alibaba and Tencent both entered the U.S. market in mid-2017. Initially, their strategy will be to serve Chinese tourists, but both firms have greater ambitions. U.S. consumers have a lot to lose if trade or investment policies prevent Alipay and WeChat Pay from entering the United States. Consumer conveniences aside, China’s mobile payments technologies are also more affordable for small business owners because acceptance fees are lower, and no separate cards or card reader devices are needed. Therefore, Alipay and WeChat Pay could force established U.S. players like Visa and Mastercard to surrender value back to consumers and innovate more rapidly, thanks to increased competition. Due to the high costs of building all-new competing payment networks, similar domestic competitors are unlikely to naturally emerge. U.S. business paid more than $88 billion in credit processing fees in 2016; that’s a lot of potential consumer savings.

"Who knows what iconic, disruptive innovations will come from China in the next decade?"

Biotechnology and pharmaceuticals

China does not yet lead the United States in biotechnology and pharmaceuticals research and development expenditure, or in the creation of therapies and drugs, but powerful demographic forces in China are rapidly propelling the industry forward. China is home to an aging population of around 1.4 billion people and has become the world’s second-largest drugs market. It sees more new cases of cancer and diabetes than any other nation. Chinese firms are racing to fill the gap, supported by the alumni of foreign biotechnology and pharmaceuticals firms and a steady stream of Chinese-trained STEM (science, technology, engineering, and math) graduates (China produces about eight times the number of STEM graduates as the United States each year).

Although the U.S. still leads in the aggregate, several cutting-edge drugs, devices and therapies emerging out of China demonstrate its innovative potential. For example, Beijing-based BeiGene is currently in late-stage trials for a handful of anti-cancer drugs that could compete globally with offerings from pharmaceutical stalwarts like Bristol-Myers Squibb, Merck, AbbVie, AstraZeneca and others. Shenzhen-based BGI now makes gene sequencing devices that compare with those of U.S.-based Illumina, the global leader. And China is leading global clinical investigations into several cutting-edge biotechnologies, including CRISPR genome editing and stem cell therapies for Parkinson's disease and other ailments. China now contributes original research and fosters increased competition in the global biotechnology and pharmaceutical industries, which can benefit U.S. consumers and literally save U.S. lives.

"China now contributes original research and fosters increased competition in the global biotechnology and pharmaceutical industries, which can benefit U.S. consumers and literally save U.S. lives."

Transportation technologies

Nothing exemplifies China’s domestic infrastructure ambitions like the nation’s high-speed rail network. Over just 10 years, China has spent an estimated $360 billion on 22,000 kilometers of track, which is more than exists in all the rest of the world. The government is planning billions of additional investment to connect four-fifths of China’s major cities by the end of the decade. With China’s massive infrastructure buildout—rail and otherwise—Chinese firms have refined their craft and now offer world-class transportation technologies at competitive prices.

For example, the World Bank estimates that Chinese high-speed train systems cost between $17-21 million per kilometer to build, compared with $25-39 million per kilometer in Europe, and more than $50 million per kilometer for the first 192 kilometers of California’s beleaguered high-speed rail project. And Chinese firms like CRRC and BYD have emerged as leaders in supplying the world with clean railcars and electric buses, respectively. Both companies have invested millions of dollars in building factories and hiring workers in the United States. CRRC and BYD’s vehicles are delivered to customers in LA, Boston and elsewhere. Other subsidiaries of major Chinese infrastructure players, like China Construction America, have also established notable presences in the U.S. They offer construction services at competitive prices and pay tens of millions of dollars in annual wages to American laborers.

It is no secret that America’s aging transport infrastructure is in urgent need of renewal. Estimates put the total required investment at more than $2 trillion through 2030, with more than half needed for highway and bridge capacity upgrades and another 20 percent required for mass transit. As the U.S. grapples with these needs in the coming years, the availability of Chinese technical expertise will be important to help Americans get the most bang for their infrastructure investment bucks. There is also considerable potential to access Chinese financing and material inputs for U.S. infrastructure projects. Policies that restrict American access to Chinese infrastructure expertise and technologies would cost American taxpayers real money.

Conclusion

China is not yet a high-tech leader in all areas, but it is making rapid progress and stands on the cusp of leadership in many technologies. The country is so large that it will naturally become a significant part of globalized innovation value chains, and an increasing share of that innovation leadership will be based on free market forces instead of industrial policies or Chinese government subsidies.

Security risks and other legitimate concerns need to be taken seriously. At the same time, we must be careful to not shut down innovative collaboration between our two nations; pulling up the drawbridge to Chinese technology would hurt U.S. consumers and businesses alike.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.