US-Asia Business

East West Bank: Helping Immigrant Entrepreneurs and Cross-Border Businesses for 46 Years

By Melody Yuan

For Asian Pacific American Heritage Month, a look at how a Chinese American bank became an international financial bridge between the East and West.

Starting a business in the 1960s and ‘70s was not easy for Asian Americans. “The big financial institutions at the time were really not interested in reaching out or working with the immigrant and Asian American population,” says Kathryn Chan Ceppi, one of the owners of Phoenix Bakery. “One of the things they didn’t realize was that in my father’s time, it would have been a point of honor to pay back any loans, and the risk of lending to this (Asian American) population would have been very low.”

Ceppi’s father was Fung Chow Chan, a key leader in the Asian American community in Southern California, and one of the founders of what is now East West Bank. An immigrant from Canton, China, Chan came to Los Angeles in 1933 and quickly realized that as a minority, gaining access to capital was a big challenge.

“Back in the day, it was very hard for minority immigrants to qualify for loans and lines of credit from a traditional bank,” says Emily Wang, senior vice president and director of marketing at East West Bank. “And as Chinese Americans trying to break through the glass ceiling for minorities and immigrants, the founders decided to build their own financial institution among other businesses to help serve their community.”

Being involved in supporting other Asian American and immigrant businesses was vital to the community, and the Chan family helped establish the groundwork for many of those small businesses, which ranged from auto shops to bakeries, around the Los Angeles area. “One of the most famous businesses they (founded) still runs today,” says Wang. “Phoenix Bakery in Chinatown is known for their strawberry whipped cream cake, as well as their almond cookies.”

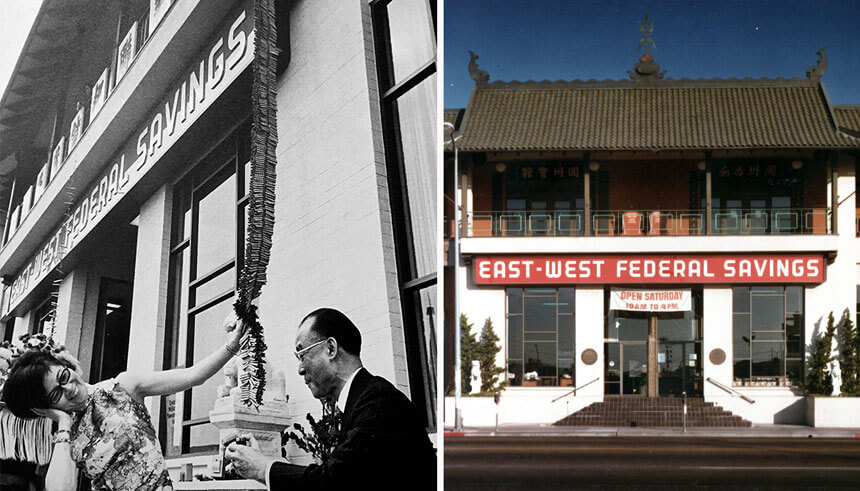

Contrary to their other burgeoning businesses, the Chan family had a hard time starting a financial institution for the community. “I was told that back in the day, it used to take anywhere from three to six months to get a bank chartered,” says Wang. For Chan, it took almost a decade to apply for a bank charter. Initially, the founders had tried to open a savings and loan institution, but after being turned down several times by state regulators, they switched strategies. Finally, in 1962, Chan helped found the first Chinese American-owned commercial bank in Southern California. “I remember back when I was in college seeing people coming in with, literally, bags of cash in paper bags taken from under their mattresses because they had no where else to put it,” says Ceppi.

However, it was not enough to serve the needs of newly arrived immigrants. After policy changes like the 1965 Immigration Act in the U.S. that eased pathways for non-European immigrants to enter the country and find work, the 1970s saw a surge in Chinese immigrants coming to the U.S. Improvements in U.S.-China relations after President Nixon’s visit to Beijing, among other initiatives, also encouraged the influx, and the number of immigrants from mainland China jumped to 299,000 by 1980. For this growing number of Asian Americans, financial necessities such as home loans or business lines of credit were not readily available. As a result, Chan and his partners, which now included two Italian-American business owners, worked once more to open a savings and loan institution, this time successfully.

“East West first opened its doors in 1973 as a thrift with one branch in Chinatown, Los Angeles, with a mission to provide access to banking services to an underserved Chinese American community. We have come a long way since then,” says Dominic Ng, Chairman and CEO of East West Bank.

As East-West Federal Savings evolved with the times, it went through many iterations and was eventually renamed and converted into a state-chartered, full-service commercial bank in 1995. Today, East West Bank is one of the fastest-growing banks in the U.S. with 130 locations worldwide, and its parent holding company, East West Bancorp, has more than $42 billion in total assets. Throughout its growth, the bank’s underlying values, commitment to customers and involvement in the community have never wavered, Wang says.

Bridge between the East and the West

In 1991, the Nursalim family from Indonesia purchased East West Bank; shortly after, they recruited Ng, who consulted them while he was at Deloitte Touche, to serve as president and CEO. In 1992, under Ng’s direction, the bank began expanding its vision to encompass both sides of the Pacific.

Seeing the surge of business between the U.S. and China markets, along with China’s growing economy and rising prosperity, Ng positioned the bank to serve as a pioneering cross-border financial institution that could help facilitate transactions for both markets. “Our vision has always been to serve as the bridge between the East and the West. That strategic direction has remained steadfast,” Ng says. In 2003, East West opened its first location in China, a representative office in Beijing.

“Our bank’s driving push was a fortunate combination of mission and execution,” says Doug Krause, executive vice president of general counsel and corporate security at East West Bank. “The mission, the business model to be a bridge between East and West, is surprisingly one that others have not focused on and is a mission that attracts good people to work here.”

The Asian Financial Crisis

1998 was a momentous year. The Asian Financial Crisis caused Southeast Asian markets to devalue their currencies, triggering a domino effect of decreased capital inflows that led to plunging investment rates and deep recessions. Based in Indonesia, the Nursalim family felt hard-pressed to sell East West Bank and free up capital as Asian economies collapsed one by one.

Ng faced a difficult decision on how to steer East West Bank forward. “The Development Bank of Singapore (DBS) was also interested in buying East West Bank,” says Wang, “but it was an agency bank here in the U.S., meaning that they really didn’t do much retail banking.” Given that East West Bank was highly involved in the community and operated many physical retail branches, the buyout by DBS would inevitably lead to job losses. “Hundreds of families would have been affected. Dominic, at the time, felt like he could find a way to save these jobs at the bank,” Wang adds.

Ng decided that the best way to move forward and to protect East West Bank’s interests was to take the company public and list the bank on the stock exchange in 1999. “This really was an opportunity in disguise,” says Susan Kelly, senior vice president of retail operations management. “They could have easily sold us to a bigger financial institution—they had that option—but Dominic had other ideas, and he and the senior management team at the time really had the vision and guts to take East West Bank public.”

Once the decision was made, Ng had to move quickly to find investors and raise enough money for the initial public offering. From zigzagging around countless cities, to flying back and forth bi-coastally, Ng and his cohorts worked tirelessly around the clock. “Dominic had only 10 days to raise enough money to take the bank public,” says Wang. “Within those 10 days, he got a commitment of $238 million. That amount may seem insignificant today, but in the ‘90s, it was a lot of money, and we called it mission impossible.” The purchase of the bank from the Nursalim family and the formation of the holding company listed East West Bancorp on Nasdaq as EWBC.

The 2008 U.S. Financial Crisis

Ten years later, the disastrous 2008 financial crisis struck the world, starting in the U.S. The subprime mortgage meltdown, fueled by years of easy credit, relaxed regulations and attractive home prices, caused major financial institutions to default left and right and shut their doors. “I remember the darkness of those days as a banker because there was absolutely no way of knowing who would come out from the recession,” says Kelly. From Lehman Brothers filing for bankruptcy and Merrill Lynch being sold to Bank of America, to the downfall of Fannie Mae and Freddie Mac, the entire banking industry was on the verge of collapse.

Ng saw the troubling signs of an impending recession early on and avoided risky loans and subprime mortgages. Then, after the housing market collapsed, the bank proactively took charge-offs ahead of schedule and raised capital, and was able to pull out of the financial crisis in good standing, which put it in a strong position to acquire United Commercial Bank in 2009. “Anyone who was working here at the time will agree that this was the most transformational factor for us,” says Kelly. “Huge financial institutions were failing, and we were in survival mode. There had to be a collective pull by the entire bank, with literally Dominic at the helm (because he had) the foresight to recognize what had to be done to navigate through these turbulent times.”

United Commercial Bank was an overseas Chinese bank in the U.S. and was a subsidiary of UCBH Holdings. It was also one of East West Bank’s biggest competitors at the time. “Just like that, overnight, East West Bank doubled in size and financial activities,” Kelly says. With the acquisition, East West Bank expanded its presence in the U.S. into states such as New York, Massachusetts and Washington. Not only that, it got a rare banking license in China and now has ten offices in Greater China, in major cities such as Beijing, Shanghai, and Shenzen. To this day, East West is one of only a handful of U.S. commercial banks that are locally incorporated in China.

The future

“The bank is full of stories,” says Wang. “We could sit here forever and talk about the many ways East West Bank has evolved. But it’s important to also recognize how the bank has stayed consistent in its values and its legacy, as a result.”

East West Bank today has grown to become one of the largest independent banks headquartered in California with a focus on the U.S. and Greater China markets. In February 2019, East West Bank celebrated its 20th year anniversary of going public—and its 46th year in business—with a bell-ringing ceremony at Nasdaq.

“Compared to when we first went public in 1999, our assets have increased by 20-fold and our net earnings by 39-fold, and our footprint has increased from 23 branches in California to over 130 locations worldwide,” Ng says.

With the ongoing trade dispute between the U.S. and China, the bank is taking a proactive stance in maintaining open business and cultural exchange. “In times of uncertainty, our role as the bridge between the East and the West is more valuable than ever,” Ng says. “It’s hard to tell what will happen, but we will find opportunities.”

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.