US-Asia Business

Do Not Turn Trade into Investment Wars

By Dominic Ng

East West Bank CEO Dominic Ng cautions the US against escalating its economic war with China at its own peril.

The United States and China are on the cusp of a tit-for-tat trade war. Initial threats of tariffs on $50 billion of products from China have escalated to talk of action against an additional $400 billion in imports. But even while all eyes are on goods trade tussles, Washington is opening another front in this battle: on investment.

Legislation to expand the authority of the Committee on Foreign Investment in the United States (CFIUS) to screen inbound investment for national security is close to passing through Congress. While some changes proposed in the bill (the Foreign Investment Risk Review Modernization Act, or FIRRMA) are warranted, I am worried that vague language will give the Trump administration too much leeway to politicize implementation. Given this President’s confrontational and unpredictable approach toward China and the international economy in general, this is concerning.

The President has said he will not impose additional restrictions on Chinese investment, which were slated to be announced on June 29th. However, parts of the cabinet have made contrary statements and, as the trade dynamics show, we cannot be sure that these restrictions are off the table. It is still possible the U.S. will impose restrictions specifically on Chinese acquisitions in high-tech sectors, as well as stricter controls for the transfer of technology developed in greenfield facilities. Like Trump’s trade policy, such restrictions would be harmful to U.S. interests and economic welfare.

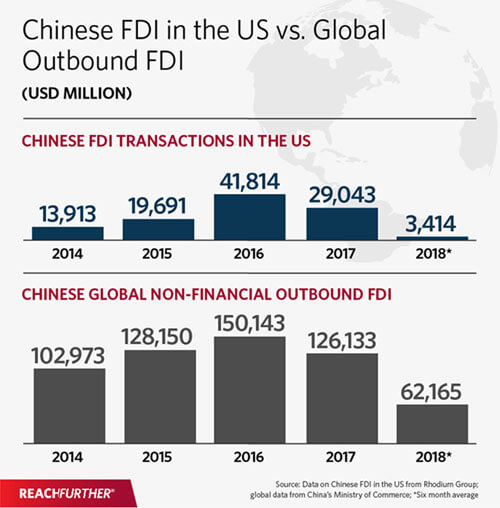

First, these types of investment restrictions in the U.S. would further diminish already flatlining Chinese investment and the associated benefits. Chinese investment climbed from next to nothing to $46 billion in 2016, bringing local development, generating taxes, creating and sustaining jobs and contributing to local innovation ecosystems. But in the past 18 months, Chinese investment in the U.S. has dropped dramatically, reaching $29 billion in 2017 and only $1.8 billion in the first five months of 2018–the lowest level in six years.

While Chinese restrictions on outbound capital flows are largely to blame for the initial drop in 2017, U.S. policy–most importantly tougher and longer CFIUS reviews and a confrontational policy stance toward China–has amplified that drop and stands in the way of recovery. China’s global outbound investment has bounced back to pre-2016 levels, and it is recovering strongly in Europe–a stark contrast to the picture in the U.S.

Additional restrictions against Chinese firms will only diminish the likelihood of any meaningful recovery for Chinese investment in the U.S. and divert Chinese capital to Europe and other advanced economies.

The United States has traditionally not screened foreign investment for economic impacts (other than competition policy), thus there is no mechanism or body within the U.S. government that is qualified (or democratically legitimized) to make such determinations. Therefore, it is likely that any investment restrictions would not be implemented through a regime that decides on a case-by-case basis, but rather a blanket ban on all investments in specific sectors or technologies. That means that productive and beneficial FDI that the U.S. wants will get caught up as well. For example, President Trump has expressed displeasure with Chinese trade and investment barriers for U.S. automakers. If the U.S. imposes restrictions on Chinese automotive investment as a result, it will not only target “malicious” investment, but also risk hugely beneficial investments like Fuyao’s auto glass plant in Ohio, or Giti Tire’s plant in South Carolina–operations that each support hundreds of the blue-collar jobs so important to President Trump. Blanket restrictions would also stifle investment in high-tech segments, such as research and development facilities in self-driving vehicle technologies by companies like Baidu, NIO and Byton, which support hundreds of high-paying jobs in the U.S. and make major contributions to world-leading U.S. tech clusters.

Imposing targeted investment restrictions on one nation will also have broader implications for the U.S. foreign investment climate. Vaguely justified restrictions targeting a specific country would break with the American tradition of non-discriminatory openness that has been a pillar of U.S. economic strength. For decades, foreign firms have invested in the U.S. based on expectations of transparent rules-based treatment, establishing U.S. operations that now support almost 7 million jobs and generate nearly $900 billion in annual economic output. Breaking with this tradition would suggest that the U.S. is no longer a safe haven of political stability and predictability. For example, companies from Germany–which also has drawn President Trump’s ire due to perceived unfair trade practices–will wonder if they will be the next targets. While unpredictability may be President Trump’s preferred negotiation tactic, it is a red flag for global investors, eroding investment confidence and putting economic opportunities at risk.

Finally, the Trump administration is underestimating China’s ability to respond in kind. China has shown willingness to match U.S. tariffs at every step and will likely react similarly on investment. While the U.S. has the upper hand in terms of the value of Chinese imports it can subject to tariffs, in the investment realm the situation is reversed, as U.S. companies have significantly more FDI assets in China than Chinese firms have in the U.S. If the trade battle spills over into investment, those companies currently enjoying profits from China’s vast market may have to deal with potential negative consequences.

What can be done to prevent trade skirmishes from escalating to something much worse that spills into investment? First, the U.S. Congress must ensure that the new FIRRMA legislation keeps the CFIUS mandate narrowly focused on national security and not economic criteria. They must also ensure that any law is then implemented in a narrow and transparent way to minimize politicization and abuse, bolstering the predictability that foreign investors need. Also, the Trump administration should refrain from imposing restrictions specifically discriminating against Chinese investors–it will only further impinge beneficial investment, erode foreign confidence in the U.S. economy and lead to real economic harm for U.S. firms and citizens. Instead of giving up on long-standing principles, the U.S. should double down on attracting foreign investment by pursuing rational investment and education policies that ensure the U.S. remains the primary target for the smartest and most innovative investors in the world.

This editorial first appeared on the South China Morning Post.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.