US-Asia Business

China Charges Onward with Electric Cars

By Daniel Allen

New regulations and buoyant consumer demand continue to drive a booming Chinese electric vehicle market.

Already home to the world's largest car market, China is now on the road to becoming a "car superpower," as it ramps up the development of smart, new energy vehicles (NEVs). Beijing has set a target for domestic NEV sales to reach 2 million units by 2020, and 7 million units by 2025 (20 percent of total vehicle sales).

Chinese automakers have so far struggled to reach a global leadership position in the automotive industry due to their relatively short history and lack of technical experience in advanced internal combustion engine (ICE) technology. The NEV market opens a window for China to potentially level the playing field and assume a more competitive position in the global industry, since multinational players have yet to establish a sustainable market leadership position.

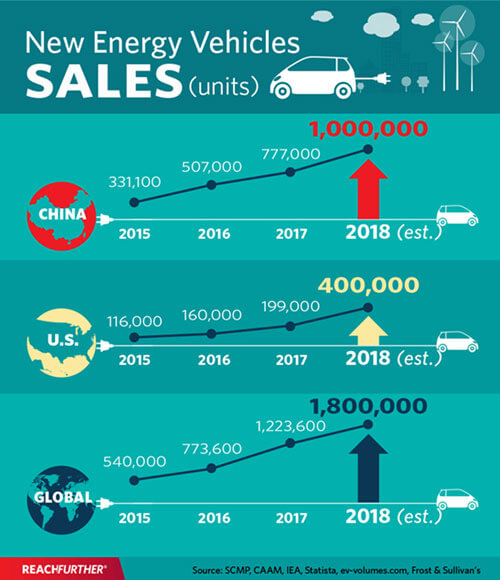

Attracted by generous subsidies and tax breaks, and restrictions on licenses for ICE vehicles, Chinese consumers have taken NEVs to heart. From 50,000 electric vehicles sold in 2014, 2018 should see sales top 1 million for the first time. Nevertheless, with electric vehicles still accounting for just 3 percent of sales, there is plenty of potential for further growth.

"This year has been another great year for China EV market development, with a growth rate of approximately 70 percent," says Neil Wu, a Shanghai-based automotive consultant for Roland Berger. "Major drivers for growth include a strong pipeline of future NEV models, increasing investment from the global OEM (original equipment manufacturer) side, and increasing acceptance of NEVs by Chinese consumers, as well as continued government policy support and the development of charging infrastructure."

“This year has been another great year for China EV market development, with a growth rate of approximately 70 percent.”

Cap-and-trade consolidation

In line with Beijing's desire to establish China as the world leader in EV production, new regulations for 2019 are set to consolidate the market and drive further technological development, while simultaneously downsizing expansion and new investment in traditional ICE automotive manufacturing.

From January 1, 2019 onwards, China-based automakers will be legally obliged to sell a certain number NEVs—defined as either battery electrics (BEV), plug-in hybrids (PHEV), or fuel cell cars—or purchase credits from other companies that surpass the quota. Those that fail to comply could, in some exteme cases, see their production lines frozen. This so-called "cap-and-trade" system is actually based on the Zero Emission Vehicle (ZEV) program, created by the California Air Resources Board nearly 30 years ago.

China's new NEV legislation is far from straightforward. Different NEV models are awarded different credit scores, according to the size of their environmental footprint. Every NEV sold generates a specific credit, relating to criteria such as electric range, energy efficiency and the rated power of fuel cell systems. Higher performance vehicles are awarded more credits, with a maximum of six credits per vehicle.

While automakers manufacturing more than 30,000 vehicles will need to obtain a NEV "credit" of at least 10 percent in 2019—rising to 12 percent next year—this means that the actual percentage of vehicles may be more or less than 10 percent. If companies are in deficit or surplus, NEV credits can be bought and sold.

Regardless of the vagaries of the system, the new rules will undoubtedly have a dramatic impact on NEV car production.

"The overall goal of these new rules is for Chinese NEV companies to be among the top 10 NEV companies worldwide by 2020, and to further expand their global impact and market share by 2025," says Bill Russo, managing director and automotive practice leader at Shanghai-based Gao Feng Advisory Company, and the Shanghai-based founder and CEO of advisory firm Automobility Limited. "Beijing has made it clear that it wants to transform China from the world's largest auto market to a global leading automotive production base."

"Beijing has made it clear that it wants to transform China from the world's largest auto market to a global leading automotive production base."

Survival of the fittest

Chinese government figures reveal there are currently almost 500 domestic EV makers in China, with most set up over the last two years. These startups have been tempted by the huge levels of funding on offer, with China's National Development and Reform Commission (NDRC) and China Construction Bank announcing last summer a new US$47 billion fund for EVs and other emerging industries. The Chinese government has flooded the EV space with money, with direct government subsidies on EV sales totaling US$15 billion over the last five years (Chinese car buyers enjoyed an average subsidy of US$10,000 per EV in 2017).

The vast majority of Chinese EV startups don't have the necessary licenses to produce and sell EVs, which means most have been forced to team up with Chinese companies unfettered by such requirements—typically state-owned car manufacturing giants such as Chery and Fujian Motor.

"One of the primary reasons China's EVs compare well with their Western counterparts is because of their partnerships with top domestic car manufacturers," says Sofya Bakhta, an analyst with Daxue Consulting, which conducts market research and management consulting from their offices in Beijing, Shanghai and Hong Kong. "For private companies such as XPENG and Nio, such partnerships have provided them with access to highly technical automotive expertise."

Beijing has been concerned for a while that oversubsidization has led to a bloated EV market. By setting the highest sales targets for NEVs anywhere in the world, China's new rules will continue to make joint ventures a necessity for small, recently established entrants, with many destined to fall by the wayside.

"According to the draft rules, BEV manufacturers are expected to have a minimum production capacity of 100,000 passenger vehicles, or 5,000 commercial electric vehicles, in order to receive and maintain their production licenses," explains Julia Coym, a senior China analyst at global consulting firm Control Risks and Chinese auto sector expert.

International impact

For almost every international carmaker, China-based sales are now hugely important. None can afford to lag behind or be excluded from one of their most lucrative markets. While many have ploughed huge sums into facilities producing internal combustion engine vehicles, China's evolving EV legislation means a growing number are now considering ramping up their EV production.

"The dual-credit management scheme, a supply side policy, is forcing both local and international OEM groups to review their EV plans in China," says Roland Berger's Wu. "We are seeing a growing number of global OEMs actively planning for the localization of their EV business in China, both in partnership buildup with local OEMs, or by accelerating introduction of their global EV models."

To date, joint ventures (JVs) have been the most commonly used method for international car manufacturers to gain a foothold in China's EV market. But with Beijing recently announcing a relaxation in rules governing the ownership of carmaking business entities by 2022, more foreign players may be enticed to set up China-based operations going forward.

“We are seeing a growing number of global OEMs actively planning for the localization of their EV business in China, both in partnership buildup with local OEMs, or by accelerating introduction of their global EV models.”

For the time being, the incentives to ramp up NEV production—both for local automakers and JV OEMs—are clear.

"With Chinese car buyers now showing a high acceptance of EV models, and emerging shared mobility platforms/mobility service providers (such as Didi, UCAR, EVCARD) actively considering EV models for their captive fleet, we are seeing more and more China-based carmakers fully prepared and well-positioned in EV production," continues Wu.

Swedish carmaker Volvo is leading the pack as far as NEV targets are concerned, having declared that all of its production line will run on electricity by 2019. Geely, which owns Volvo, is aiming for 90 percent of its total annual sales of nearly 2 million vehicles to be battery electric vehicle or plug-in hybrid electric vehicle by the following year. Other Chinese carmakers, such as Changan, BAIC, SAIC and Chery, have also committed themselves to ambitious EV sales targets over the next few years.

EV enhancement

The Chinese government may be pushing the electric vehicle agenda aggressively, but it has other big plans for its domestic auto manufacturing industry, as well. Beijing sees the Chinese automobile of the near future as not only electric, but smart and autonomous, too: The NDRC unveiled a three-year plan in late 2017 to make the development of smart cars a national priority.

Smart cars typically feature road safety monitoring, intelligent entertainment and voice interaction, while autonomous or self-driving cars are equipped with systems including radar and GPS, enabling them to "sense" their surroundings and identify optimum routes. By encouraging car makers to integrate these technologies into EVs, the Chinese government wants to improve traffic safety and solve road congestion issues, as well as lower energy consumption and greenhouse gas emissions.

In August, China issued national standards for the testing of autonomous vehicles, with the move expected to smooth the way for the development of autonomous driving in China. According to a blueprint released by the NDRC in early 2018, the Chinese government wants half of all new smart vehicles sold in 2020 to feature some kind of autonomous functionality. Germany's three largest car manufacturers—Audi, BMW and Mercedes-Benz—have all recently begun testing autonomous vehicles in China, despite rules that compel them to collaborate with Chinese software firms.

Making the connection

Given China's push toward smart, self-driving EVs, Russo believes China-based car makers must expand their focus from the product (the automobile), to the utility derived from the product ("automobility"), creating business models and ecosystems that provide digitally enabled solutions to both car owners and mobility services users.

"China recently entered the 'automobility 2.0 phase,' when cars will be built specifically for connected mobility services," says Russo. "The defining characteristics of cars used in this manner include high utilization rates and user-centric features that enable connectivity. Such cars will be powered by electricity, due to their lower operating cost."

According to Russo, new business models and upgraded, on-demand mobility services are now addressing mobility pain points observed in China's "automobility 1.0 phase." These include congestion, surging prices, service inconsistency, safety and security concerns, a lack of personalization and charging infrastructure, and inconvenient parking lots.

"After 2020, China will enter the 'automobility 3.0 phase,' when autonomous driving technologies are expected to become commercially viable," Russo adds. "China's future automobility business model can be described by a combination of the terms 'personalized,' 'electric,' 'shared' and 'autonomous mobility on-demand.'"

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.