US-Asia Business

Busting US-China Trade Deficit Myths

East West Bank CEO Dominic Ng sets things straight on trade figures that he calls outdated.

(This is the first editorial of a three-part series on the misunderstandings of the U.S.-China trade relationship.)

Public opinion in the United States has turned against free trade. Donald Trump’s election win was tied to an aggressive campaign promising to address trade imbalances, with a particular focus on Chinese trade practices. On the campaign trail, Trump remarked that “China is responsible for nearly half of our entire trade deficit. They break the rules in every way imaginable.”

Without doubt, there are problems in the U.S.-China trade relationship. However, the current officially reported U.S.-China trade numbers are grossly inaccurate. They are based on outdated methods of data collection and calculation that were agreed to in the aftermath of World War II, and they have not been properly updated to reflect today’s global economy. It is concerning that world leaders are primarily relying on these misleading trade figures to make major decisions that have the potential to damage economies and create ill will among nations that heavily depend on each other for their prosperity.

"It is concerning that world leaders are primarily relying on these misleading trade figures to make major decisions."

Traditional trade data are outdated and tell a distorted story

Let me explain why the trade data our leaders are using is problematic. Statistics traditionally used to measure trade flows do not fully reflect the globalization of production chains. Currently, statistical agencies pin the entire trade value of a product to the last place it was exported from, even though the parts in the product come from many other countries. This method of data collection is based on the International Monetary Fund’s Balance of Payments Manual, which was first released in 1948, and never appropriately overhauled to reflect the new complexities of global value chains.

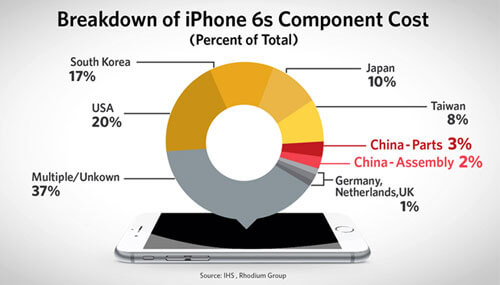

In the case of China, this means that commonly cited trade figures are distorted by the fact that China has become a final assembly point for many goods that contain a significant number of parts from other nations. The classic example is the Apple iPhone. Apple takes care of design, development, marketing, and software creation for its phones in the U.S. High-value components of the iPhone come from different countries: Among the myriad iPhone 6 parts, displays are manufactured in South Korea, Japan, and elsewhere; processors come from the United States; touch ID sensors are made in Taiwan; and barometric pressure sensors come from Germany. Final assembly takes place in China. Because of this, even though the assembly and parts cost of the iPhone in China is only a tiny fraction of the total manufacturing cost, the entire import cost of the iPhone is attributed to China in U.S. trade statistics. These distortions add up—assuming 35 percent of the 215 million iPhones sold globally in 2016 were imported for sale in the United States at a cost of $230 each, the iPhone alone added $17 billion to the 2016 trade deficit with China, even though the vast majority of its inputs came from elsewhere.

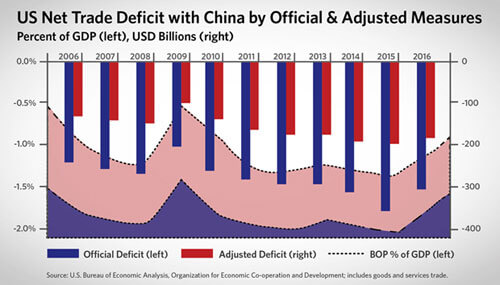

Clearly, the U.S. trade deficit with China is overstated. Official trade statistics compiled by the U.S. Bureau of Economic Analysis record a U.S. net trade deficit with China of $309 billion in 2016, or 1.7 percent of U.S. gross domestic product (GDP). In reality, it is much lower than that. The Organization for Economic Co-operation and Development (OECD) has pioneered value-added methods for tabulating trade that paint a more accurate picture based on country of origin for each of an export’s components. This dataset shows that in 2011, the U.S. net trade deficit with China, based on the actual Chinese and American value added to final goods and services traded between the two nations, was more than 40 percent lower than the traditional trade statistics suggest.

While data for recent years is not available, if we assume a stable ratio between traditional and value-added data, then the adjusted U.S. trade deficit in 2016 with China would come down from $309 billion to $169 billion. This is still a high number, but a much more sensible and useful starting point for discussions about policies to reduce U.S. trade imbalances with China.

Public debate largely ignores the U.S. services trade surplus with China

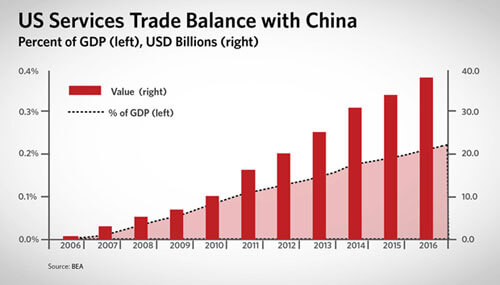

Another problem in the current public debate is the sole focus on the trade of goods, while ignoring trade in services. While still small compared to the goods trade deficit, the United States runs a significant and rapidly growing surplus with China in trade of services including tourism, education, financial and other professional services. The U.S. services trade surplus with China increased from an annual average of less than $2 billion from 2000-2008 to $37.4 billion in 2016 (0.2 percent of U.S. GDP).

While there are also problems with accurately measuring services trade flows, these numbers show that the deck is not unilaterally stacked against the United States. American companies are strongly competitive in high value-added services like banking, software and education, and can capitalize on market opportunities in China arising from the growing number of Chinese middle-class consumers. The U.S. services trade surplus has increased every year for the past 10 years; policies that encourage China to reduce market barriers for U.S. companies in banking, film, and other sectors should go a long way in further boosting U.S. services exports and shrinking the overall U.S. trade deficit with China.

The challenge of measuring national welfare impacts

The third challenge that distorts the public debate on U.S.-China trade relations is that some of the negative impacts are easier to track than the benefits. There’s no question that trade integration with China has had negative impacts for specific demographics and regions in the U.S., particularly for workers in low value-added manufacturing sectors. However, it is important to keep in mind that the goods trade deficit with China has also yielded tangible benefits to the United States.

For example, trade with China has generated substantial savings for American consumers. Cheaper overseas imports from China have helped to lower overall inflation. U.S. consumers enjoy prices lower today than they would otherwise be, thanks to trade with China. A family making close to the median U.S. income has benefited from annual savings of approximately $500 to $1,000.

In addition to consumer benefits, trade with China has also hugely benefited the U.S. from an environmental and quality-of-life perspective. Lower-end manufacturing operations often generate substantial waste and pollute the local air and water, particularly in heavy industries. As that manufacturing activity has migrated to China, the U.S. has effectively exported much of the pollution associated with these operations. Americans today breathe cleaner air and fish in cleaner waters, thanks to China.

Finally, and perhaps most importantly, trade integration with China has helped the United States to focus efforts toward higher value-added activities. By outsourcing the production of low value-added goods to China, the U.S. has been able to specialize in the production of high-tech goods and services, and increase productivity in those areas. Many Americans would not have the standard of living and employment they currently enjoy without foreign markets like China for U.S. services and other higher value-added exports. These benefits are often more difficult to measure and thus do not receive significant attention.

Issues to tackle next

The U.S. government should explore policies that help reduce the perceived unfairness of the bilateral trade relationship. At the same time, it is critical that those debates are objective and based on facts. Statistical offices should update their methodologies so that the public and political decision makers have access to the full picture of what’s really going on in the U.S.-China trade relationship.

Better statistics would go a long way to help us overcome myths and political gamesmanship, and instead identify and tackle the real problems in the U.S.-China trade relationship, which clearly exist. Market access is lopsided; U.S. firms face a host of tariff, regulatory, and Foreign Direct Investment barriers that Chinese firms do not face in the United States. In addition, Chinese industrial policy has created overcapacity in steel and other sectors that threaten to spill over into U.S. and global markets, and new plans such as Made in China 2025 reveal intentions to support Chinese producers at the expense of foreign firms. China has also not lived up to U.S. expectations related to China’s World Trade Organization accession, and it is dragging its feet on joining international agreements such as the Government Procurement Agreement and an expanded Information Technology Agreement.

In next month’s editorial, I will explore these issues more fully. In the final editorial of this series, I will suggest effective strategies for addressing those problems. Stay tuned.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.