Entrepreneur Insight

What Does Biden’s Proposed Tax Plan Mean for Businesses and Individuals?

By Angela Bao

A breakdown of President Biden’s proposed changes to the tax law to help fund the Build Back Better plan.

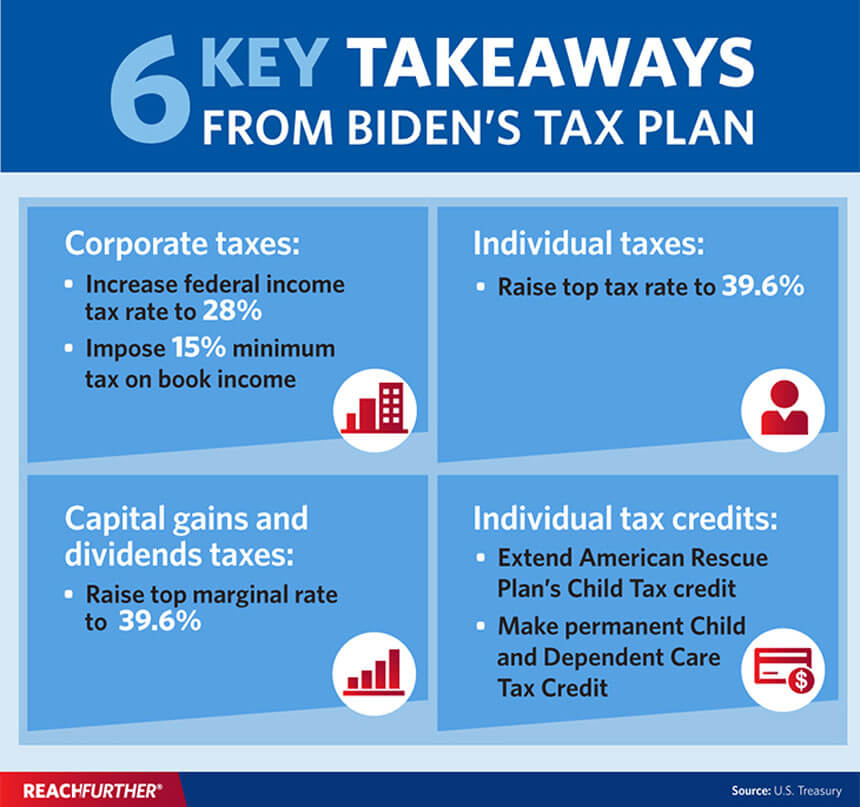

As part of his three-part Build Back Better plan, President Joe Biden has drafted a number of tax proposals to help pay for proposed infrastructure improvements and at least four additional years of free public education for children. The proposed changes would increase taxes on corporations and wealthy Americans, as well as extend certain tax benefits that are set to expire by the end of 2021.

Here are the major changes Biden has proposed that business owners and individuals should be aware of.

What is the Build Back Better plan?

President Biden’s Build Back Better plan is comprised of three parts: the American Rescue Plan (which has already been enacted), the American Jobs Plan and the American Families Plan.

The American Rescue Plan provided direct relief to people by sending out $1,400 stimulus checks per person, extending unemployment benefits until September 6, 2020, and increasing the Child Tax Credit, Earned Income Tax Credit, and Child and Dependent Care Tax Credit.

The American Jobs Plan is Biden’s proposal to invest nearly $2.3 trillion in infrastructure and jobs over eight years, which will primarily be funded through increased taxes on corporations over 15 years. The Jobs plan allocates $1.3 trillion for transportation and community infrastructure spending, which includes areas such as roads and highways, public transit, electric vehicles, clean drinking water, housing, broadband internet, and more. Another $580 billion will also be designated for workforce development, R&D and manufacturing, with a focus on investing in semiconductor manufacturing, medical manufacturing, small business and clean energy.

The American Families Plan will provide $1.8 trillion to assist families and workers, and will be funded primarily through tax increases on high-income Americans. The Families plan will provide at least four additional years of free public education for children; provide 12 weeks of guaranteed paid parental, family, personal sick/safety leave for workers; and make permanent some tax credits implemented in the American Rescue Plan.

Breakdown of the proposed corporate taxes

In 2019, the Institute on Taxation and Economic Policy found that 379 Fortune 500 companies that were profitable in 2018 paid an average effective federal tax rate of 11.3% on that year’s corporate income, which is about half the current statutory corporate tax rate of 21%. Of those companies, 91 of them (which include big names such as Amazon, Chevron and IBM) effectively paid no federal taxes on their 2018 U.S. income.

Peter Hong, senior vice president of wealth management at East West Bank, says that the biggest proposed tax change in the American Jobs Plan is to raise the federal corporate income tax rate to 28%. That tax rate will still be lower than the 35% corporate tax rate that was effective from 1994 to 2017, until the Trump administration implemented the Tax Cuts and Jobs Act. The American Jobs Plan will also repeal the current exemption for the first 10% return on foreign investment, end the preferential tax rate on the remainder of foreign investment profits, and levy a minimum tax of 21% on multinational corporations’ income (applied on a country-by-country basis).

Hong adds that, recently, Biden has also indicated that he will instead shift focus to a minimum 15% tax rate on corporate book income in an effort to garner more GOP support for his plan.

The biggest concern for corporations, says Hong, is the impact the higher taxes could have on their cash flow. “So, let’s say a small business made $10 million net profit before taxes,” Hong gives as an example. “Right now, they only have to pay 21%, so they need to pay $2.1 million. But at the proposed rate of 28%, then you have to prepare $2.8 million. Scale that up to $100 million, and that’s a difference of between $21 million and $28 million—that’s huge.”

Even with high certificate of deposit (CD) rates, businesses could still be losing purchasing power after the tax increase. “Therefore, we need to better manage that cash flow, given this working capital,” states Hong. Some solutions could include fixed annuities, which get higher interest rates that could help cover the difference.

“Fixed annuities usually pay much higher interest rates than CDs, without interest rate risk or market risk,” Hong explains. “For individuals, fixed annuities have additional benefits such as tax deferral. Corporate-owned fixed annuities would enjoy higher interest rates, but would not have the additional benefit of tax deferral. So, corporate-owned fixed annuities are taxed similar to a CD—interest earned is taxable.”

Breakdown of the proposed individual taxes

Hong says that Biden’s proposal provides a lot of benefits for certain families, “like for families caring for children, elderly relatives, first-time homebuyers and people purchasing electric vehicles, and also for low-to-middle income taxpayers.”

For example, the American Families Plan would extend the child tax credit, which had been raised to $3,600 per child under age 6 and to $3,000 per child ages 6 through 17. It would also make permanent the child and dependent care tax credit, which had been increased up to a total of $4,000 for one qualifying child or $8,000 for two or more qualifying children in the American Rescue Plan. Experts estimate that these measures could contribute to reducing childhood poverty by 50%.

Perhaps some of the biggest changes Biden has proposed are on how wealthy individuals will be taxed. For the top 1% of taxpayers, the top income tax rate would increase from 37% to 39.6%. Additionally, Hong notes that people making over $400,000 a year will see tax increases. “Right now, the maximum Social Security taxable earning is set at $142,800. So, if you make more than that amount, after that there’s no Social Security tax withholding anymore,” Hong explains. “But it looks like they are imposing a 12.4% additional Social Security tax for people making high income.”

In the proposed plan, Biden would also eliminate the Section 199A deduction for these individuals and cap the itemized deduction at 28%, says Hong. For individuals making over $1 million a year, the capital gains federal tax rate could increase from the current top rate of 23.8% to 43.4%.

Another big change is Biden’s plans for federal estate taxes. “Right now, an individual is exempt from estate taxes [for the first] $11.7 million; for a couple, you double that to $23.4 million,” says Hong. “The expectation is there’s a good likelihood that individual exemption amount can be reset at $5 million, or even lower at $3 million.” The proposal would also eliminate certain tax loopholes, such as the step-up in basis rule, which allows families to pass down property without having to pay taxes on any increases in property value over time.

How to prepare for the coming tax changes

Biden’s tax plans are still subject to change, but business owners and individuals should prepare as best they can. Hong recommends reaching out to a wealth management advisor to receive “financial planning and customized advice” to help plan for the future.

“One thing I learned during the pandemic is that some business owners assume their business is going to continue forever. They were not prepared for contingencies—they didn’t have enough cash set aside,” Hong shares. “They didn’t have a separate portfolio set aside for their retirement, regardless of how their business performed. This pandemic is going to change the world in many different ways. Some industries are going to be completely disrupted, and it’s going to change how we prepare, how we do our business, how we set our cash aside, how we set up a separate retirement pool.”

To speak to an East West Bank Wealth Management advisor, click here.

Sign up for the Reach Further Newsletter

We’ll keep you in the know about the latest US-Asia business news and trends.

Suscríbase al boletín Reach Further

Lo mantendremos informado sobre las últimas noticias y tendencias comerciales entre Estados Unidos y China.